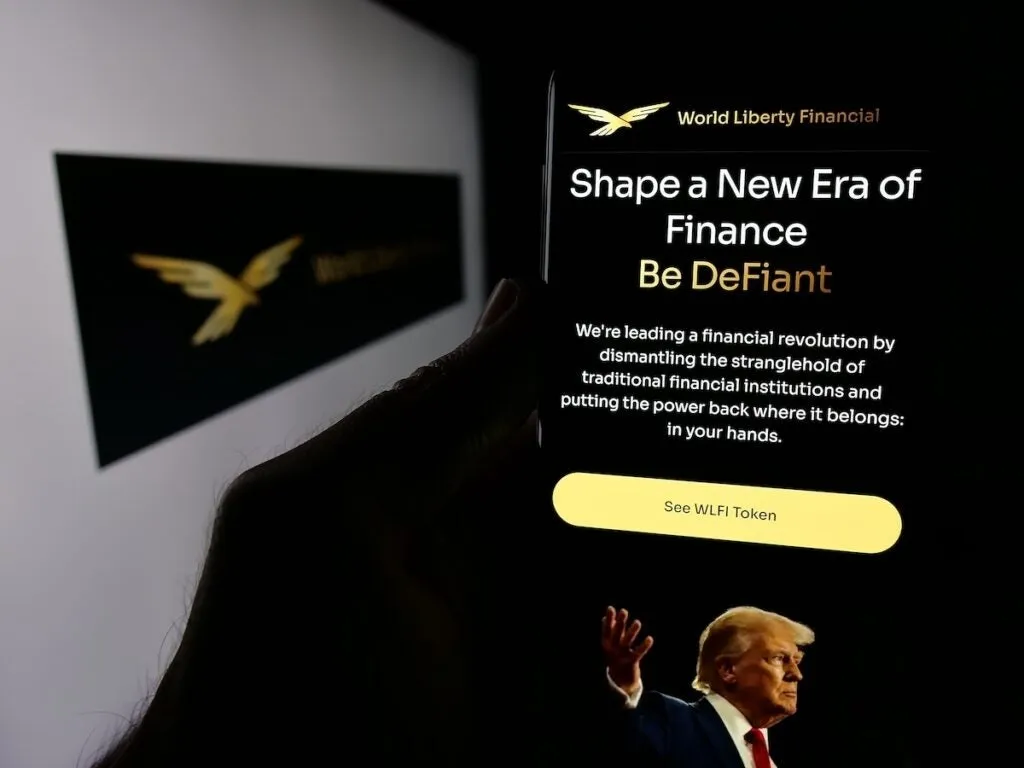

World Liberty Financial Token ($WLFI) and Its Impact on the Crypto Market

The World Liberty Financial ($WLFI) token experienced a sharp decline following its initial promising performance in the cryptocurrency market. After an impressive debut, the currency struggled as market conditions shifted. This article delves into the reasons behind this drop and what it means for both investors and the crypto landscape.

Factors Behind the Token’s Initial Rise

Initially, the World Liberty Financial token attracted attention due to its unique value proposition in the decentralized finance space. Key elements included:

- Strong backing from the Trump family, elevating its profile.

- Innovative use cases within the cryptocurrency ecosystem.

- Market enthusiasm fueled by the launch hype.

Subsequent Decline: What Went Wrong?

Despite the initial buzz, several factors led to the token's downturn:

- Market corrections that often follow a new token launch.

- Investors re-evaluating the fundamentals and long-term viability.

- Increased competition in the crypto space, particularly from established tokens like $ETH and $BNB.

Implications for Investors

As the $WLFI stabilizes, market participants need to consider the following:

- Assessing risk before engaging in new token investments.

- Staying informed on market trends and updates in the cryptocurrency sector.

- Understanding how external factors, like investor sentiment and regulatory changes, influence token performance.

In conclusion, while the World Liberty Financial token had a rocky start, it serves as a reminder of the volatility inherent in cryptocurrencies. For continuous updates and detailed analyses, stay tuned to our crypto news section.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.