Bitcoin Price Fears: Understanding BlackRock's ETF Influence

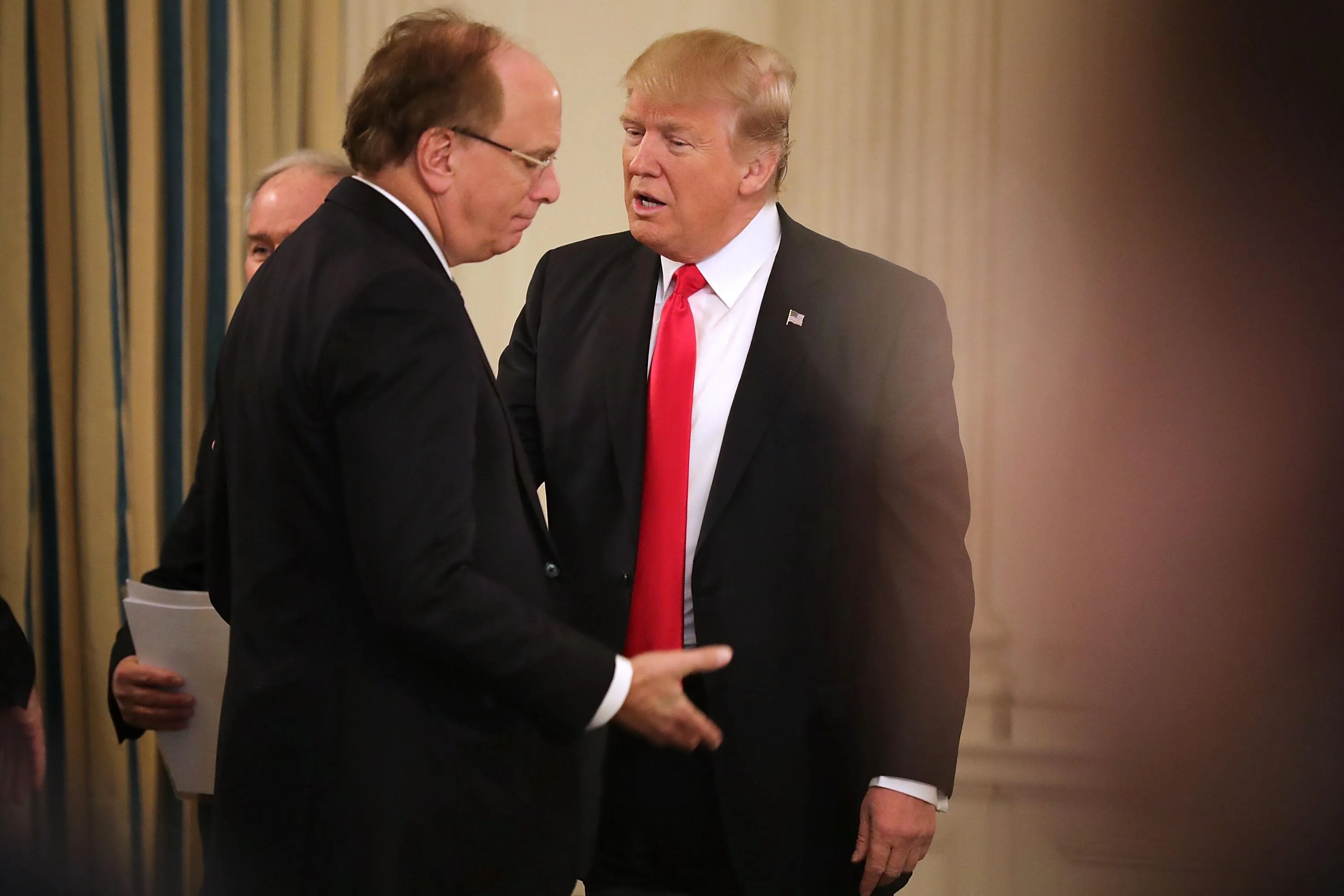

BlackRock's Role in the Crypto Market

BlackRock has emerged as a major player in the crypto market, managing approximately $10 trillion in assets. Its recent focus on a bitcoin ETF raises questions about the future of bitcoin.

Market Reactions

The announcement of a potential spot bitcoin ETF led to a notable increase in market volatility, resulting in a $200 billion sell-off. What does this mean for investors?

Implications for Investors

- Heightened market volatility

- Increased interest in bitcoin

- Policy implications from regulatory bodies

Conclusion

As BlackRock continues to vie for a dominant position in the bitcoin space, market participants must stay informed of potential shifts.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.