Banking and Finance: Understanding the Risks of Loosened Regulation

Banking and Finance Under Scrutiny

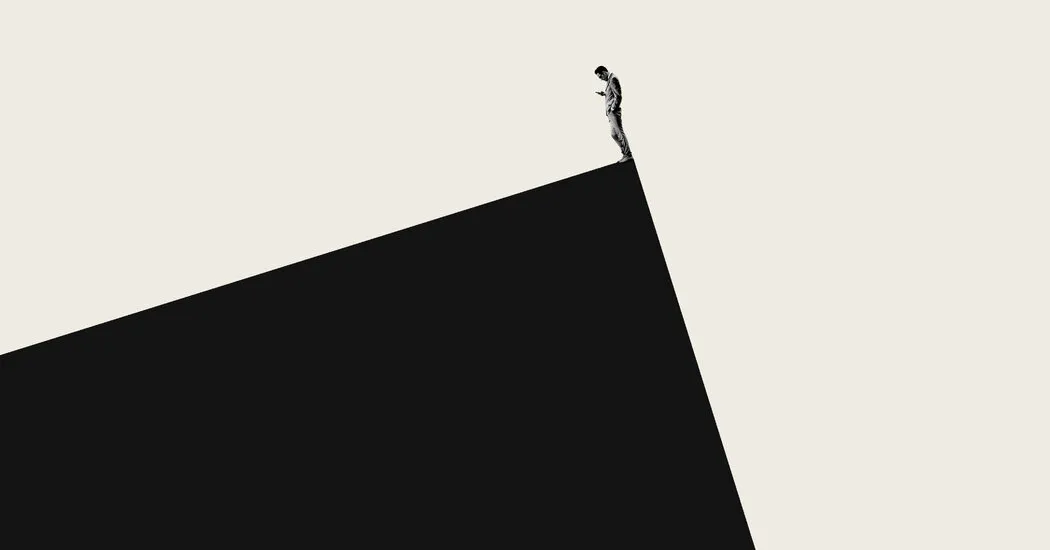

Recent trends in banking and finance suggest a significant shift as regulatory measures loosen. Financial experts are encouraging investments in private equity and the increasingly popular crypto market. This approach may resemble the risky atmosphere of the 1920s, raising concerns about potential repercussions.

Regulatory Changes and Their Effects

The Consumer Financial Protection Bureau and the SEC are key players in shaping regulation and deregulation. As the landscape changes, investors may find themselves drawn to options like venture capital and hedge funds.

- Potential for increased returns

- Higher volatility and risks

- Need for thorough financial planning

As history has taught us, the years leading up to the 1929 crash were marked by similar trends. Investors today should remain vigilant and informed.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.