Bitcoin Traders Boost Interest in Deribit Options for $100,000 Rally

Monday, 5 January 2026, 02:02

Overview of Bitcoin Price Expectations

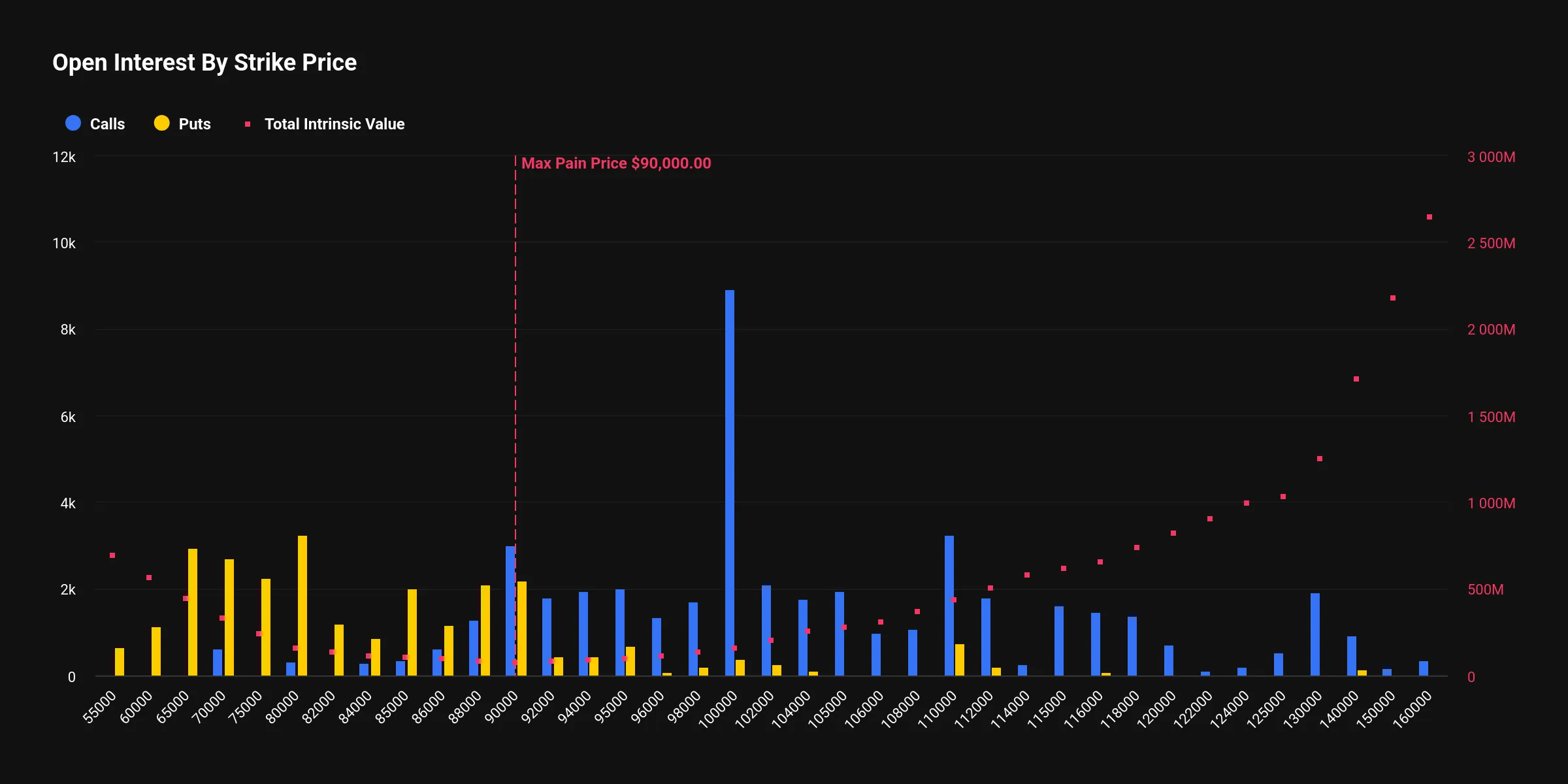

Bitcoin traders are confidently placing their bets as 2026 kicks off. With a heightened focus on $100,000 call options on Deribit, the demand has surged. The January options have emerged as the most favored choice among traders.

Key Highlights of Deribit Options

- Strong Open Interest: The January $100,000 call option has a notional open interest of $1.45 billion, marking it as a top contender.

- Market Sentiment: An increasing number of traders are expressing bullish sentiments surrounding Bitcoin's price trajectory.

- Strategic Positions: Traders leveraging derivatives to position themselves for potential price movements indicate a proactive market approach.

In conclusion, as 2026 unfolds, the Bitcoin market reflects a significant surge in optimism, especially around Deribit's derivatives.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.