Anglo American to Sell De Beers in Break-up Plan to Avoid BHP Takeover

Anglo American's Break-up Strategy to Defend Independence

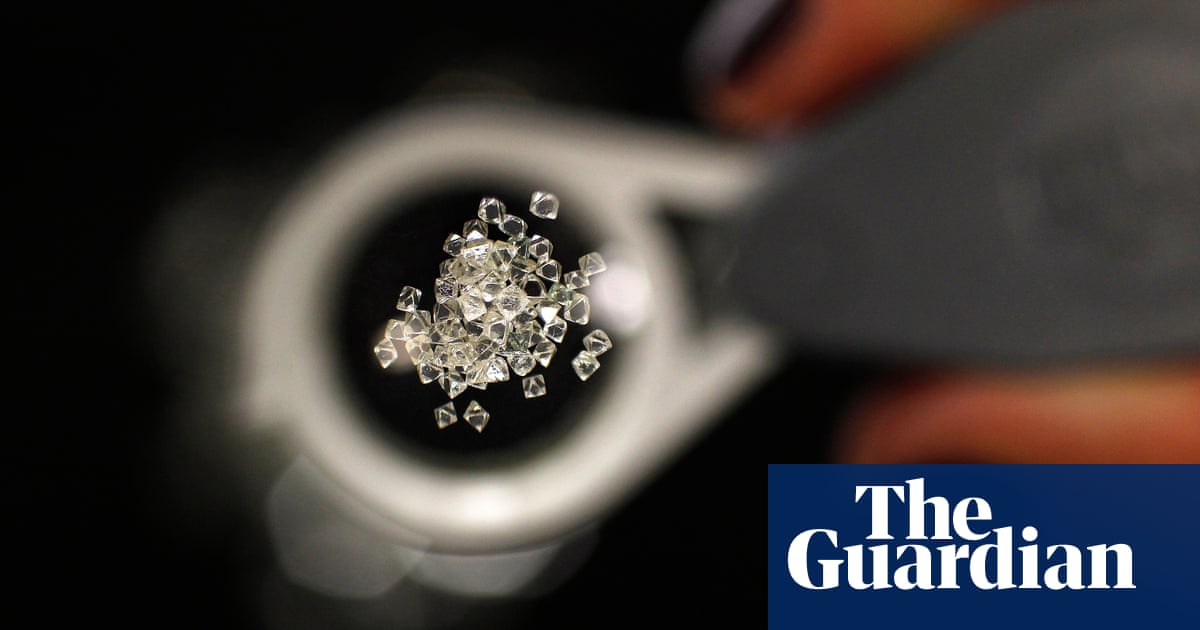

UK mining company Anglo American is set to sell off its renowned diamond business De Beers as part of a bold defensive move after rejecting a £34bn takeover offer from Australian rival BHP. The sale of De Beers, the largest diamond miner globally, is a pivotal step in the company's effort to thwart BHP's acquisition attempts.

Radical Restructuring Plans

- Bold Move: De Beers sale amidst rejection of second unsolicited takeover bid.

- Market Response: Shares react to the news of Anglo American's defensive strategy.

The escalated tension between the mining giants signals a high-stakes battle for control within the industry, shaping the future landscape of diamond mining and global competition.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.