Wall Street Banks Compete for Australian Pension Funds to Offer Hedging Solutions

Goldman Sachs and Bank of America Target Australian Pension Funds

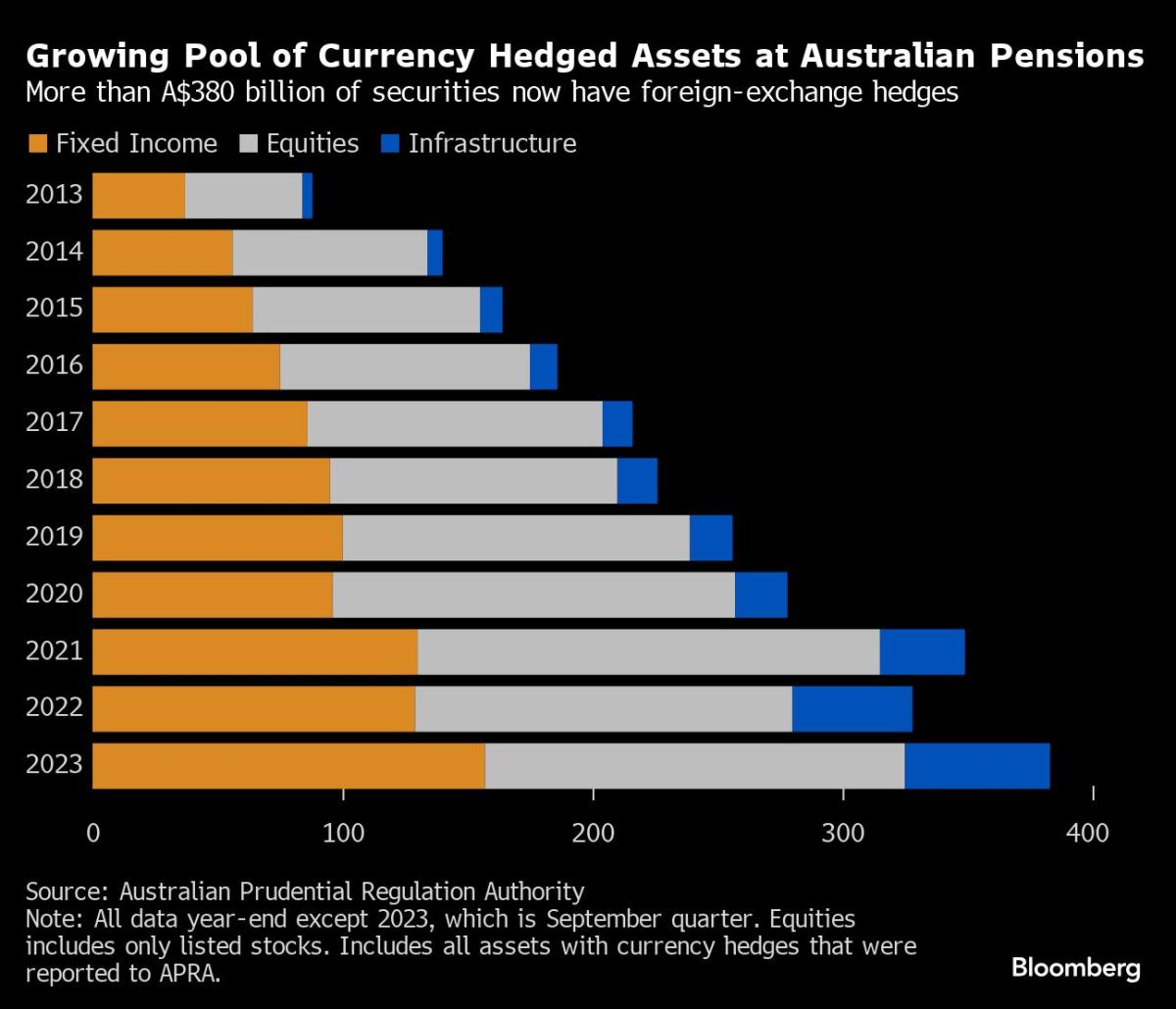

Wall Street banks are actively seeking opportunities to provide hedging services to Australia's pension sector. The Australian pension industry, known for its significant overseas investments, is attracting attention from major financial institutions.

Competition for Business

- Goldman Sachs and Bank of America are vying for a share of Australia's pension market to offer tailored hedging solutions.

- Both banks aim to address the challenges of managing risk in the growing pool of retirement savings.

The competition highlights the increasing demand for effective hedging strategies in the Australian pension industry.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.