Advanced Micro Devices: Evaluating the ZT Acquisition and its Implications for AMD Stock

Advanced Micro Devices: Analyzing the ZT Acquisition

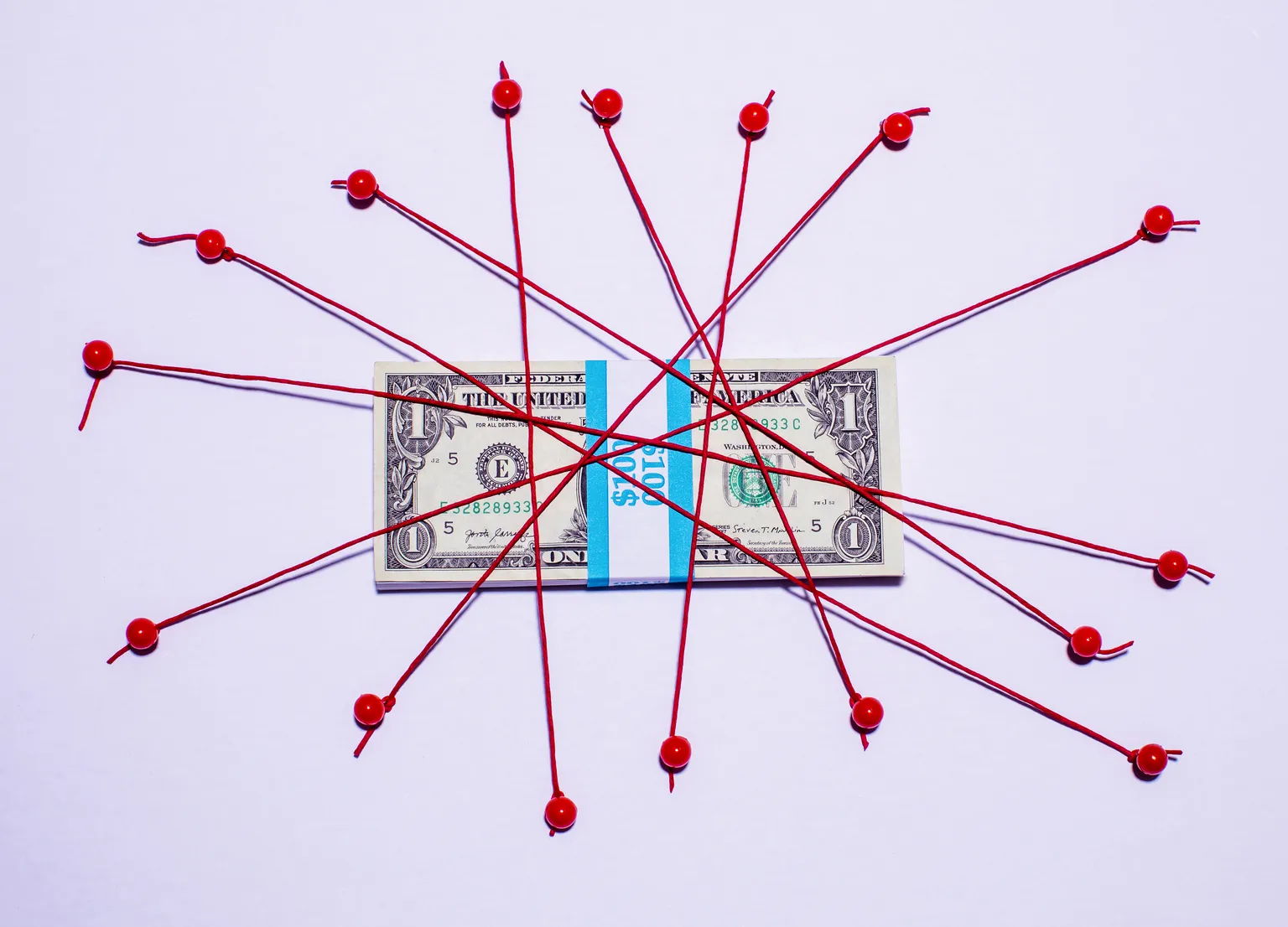

Advanced Micro Devices has made headlines with its recent $4.9 billion acquisition of ZT Systems, aimed at bolstering its presence in the AI market. However, this might not be as favorable as it appears. Analysts warn that the integration challenges and financial implications could undermine AMD stock growth.

Context and Concerns

- High Valuation: At $4.9 billion, the acquisition comes with significant financial risk.

- Market Reactions: Early market responses suggest skepticism among investors.

- AI Market Dynamics: Increased competition and pressure in the AI sector may pose additional challenges.

Investment Implications

Investors may want to consider a sell rating on AMD stock as the company navigates this acquisition, given the uncertain forecast in the ever-evolving tech landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.