Rogers Eyes Growth In EV And Renewable Energy Markets Amid Profit Challenges

Rogers’ Strategic Investments in EV and Renewable Energy

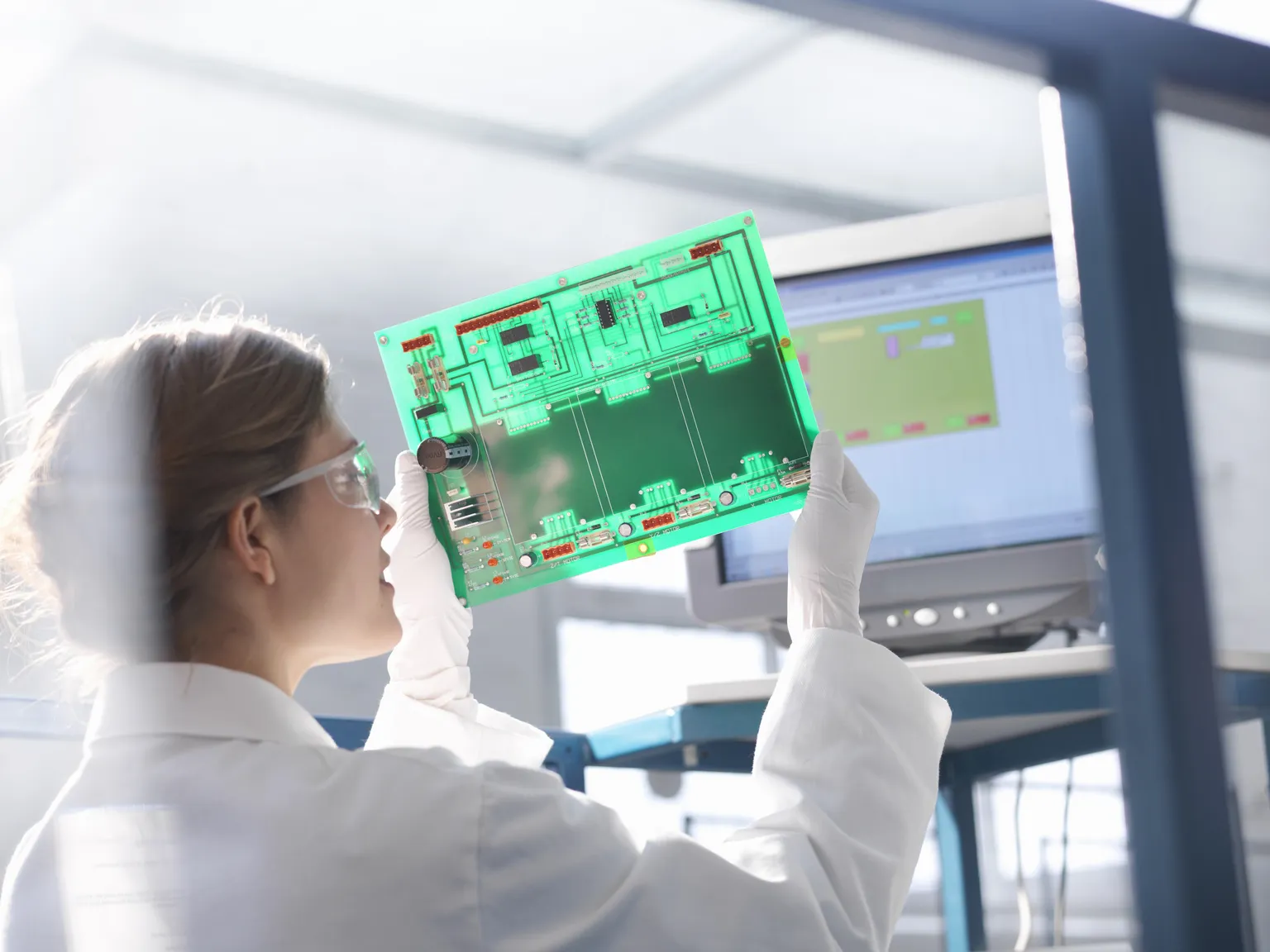

Rogers Corporation is significantly ramping up its sustainable materials efforts to capitalize on burgeoning opportunities in the electric vehicle (EV) and renewable energy sectors. Positioned on the cutting edge of technology, Rogers is focusing on innovations that enable the next generation of clean energy solutions.

Challenges in Profitability

Despite its optimistic outlook, Rogers faces several profit challenges that impact its immediate performance. The competitive landscape in the renewable energy and EV sectors means that maintaining margin levels can be tough, but the long-term growth potential remains intact.

Future Outlook for ROG Stock

Investors should consider ROG stock as a promising opportunity as the company pivots towards more sustainable operations. The underlying demand for EVs and renewable energy products makes Rogers a compelling choice for those looking to invest in future growth.

Conclusively, the blend of investments in sustainability and the potential for market expansion can yield substantial returns for those willing to navigate the current profitability hurdles.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.