Takeover Bid by KKR for ASMPT: Financial Insights and Implications

The Proposal: KKR's Takeover Bid

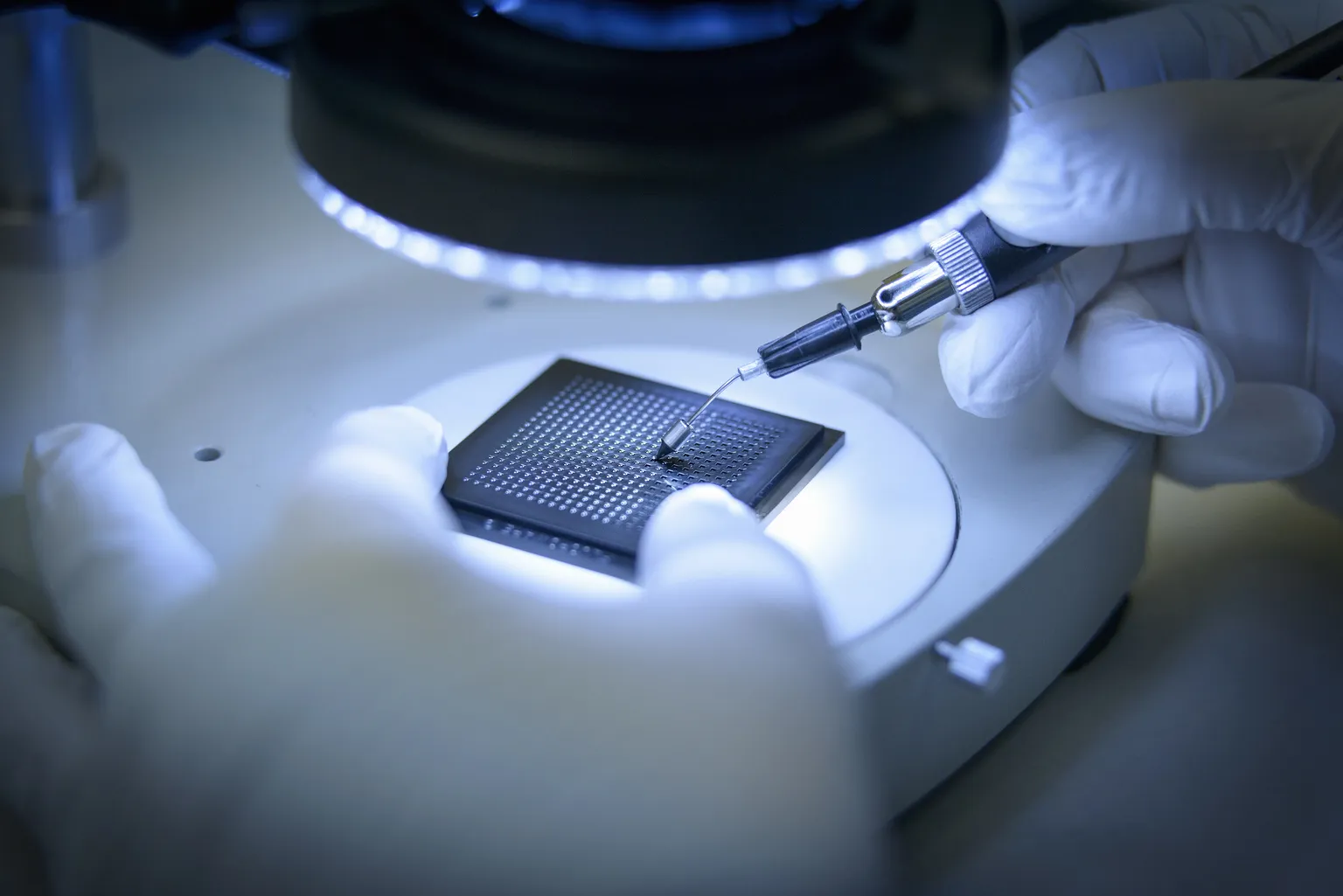

KKR is reportedly engaged in discussions for a takeover bid of ASMPT, a key player in the semiconductor equipment sector. As one of the leading private equity firms, KKR's interest in ASMPT underscores the competitive dynamics within this rapidly expanding industry.

Market Reactions

- The news has sparked considerable interest among investors.

- Market analysts predict various outcomes based on KKR's strategy.

Implications for ASMPT

This potential acquisition could provide ASMPT with enhanced resources and market reach. Stakeholders should remain vigilant about forthcoming announcements and shifts in market positions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.