US: 10-Year Treasury Yield Hits 4% and Keeps Equity Bulls in Check

Understanding the 10-Year Treasury Yield Surge

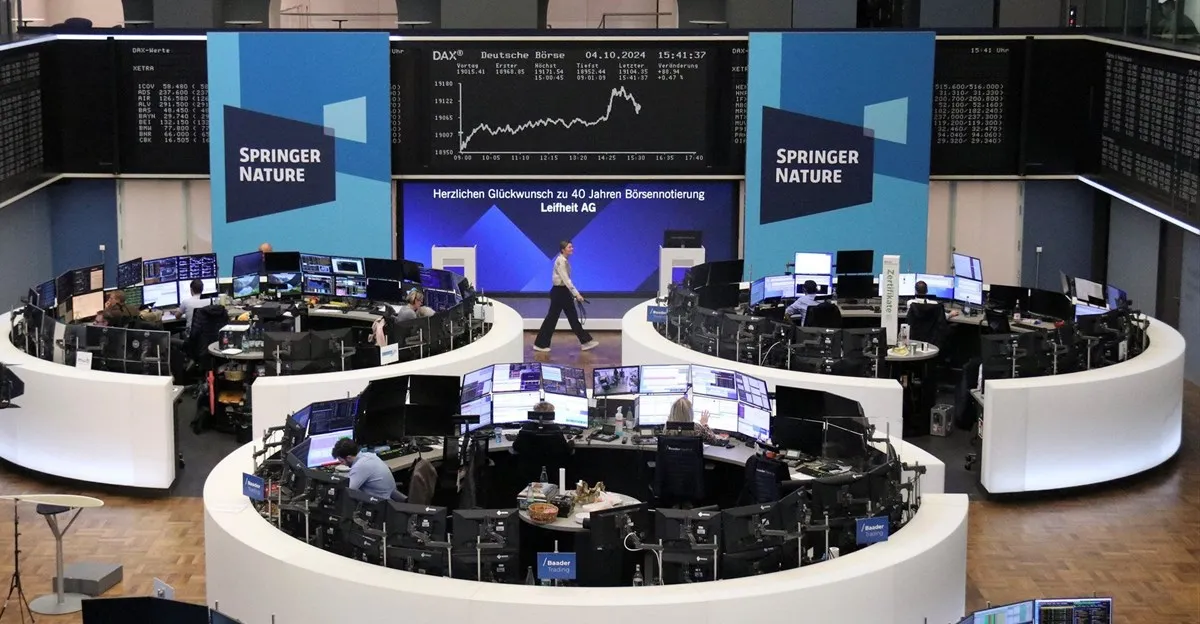

The benchmark 10-year Treasury yield reached 4% on Monday, 7 October 2024, significantly impacting financial markets. This increase, prompted by last week's positive US labor market report, has diminished recession fears and revised market projections for rate cuts.

Implications for Equity Markets

- The rise in yields has led to a cautious approach among equity investors.

- Higher borrowing costs may weigh on corporate profits and investor valuations.

- The relationship between Treasury yields and stock prices proves to be crucial for market strategies.

Market Reactions and Future Expectations

As yields climb, equity bulls are forced to reassess their positions. Market forecasts might shift towards a more conservative outlook as interest rates stabilize. Investors keep a close watch on economic indicators to navigate through this evolving landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.