Gold Price Forecast: Geopolitical Tensions and Inflation Impact XAU's Trajectory

Geopolitical Tensions Drive Gold Demand

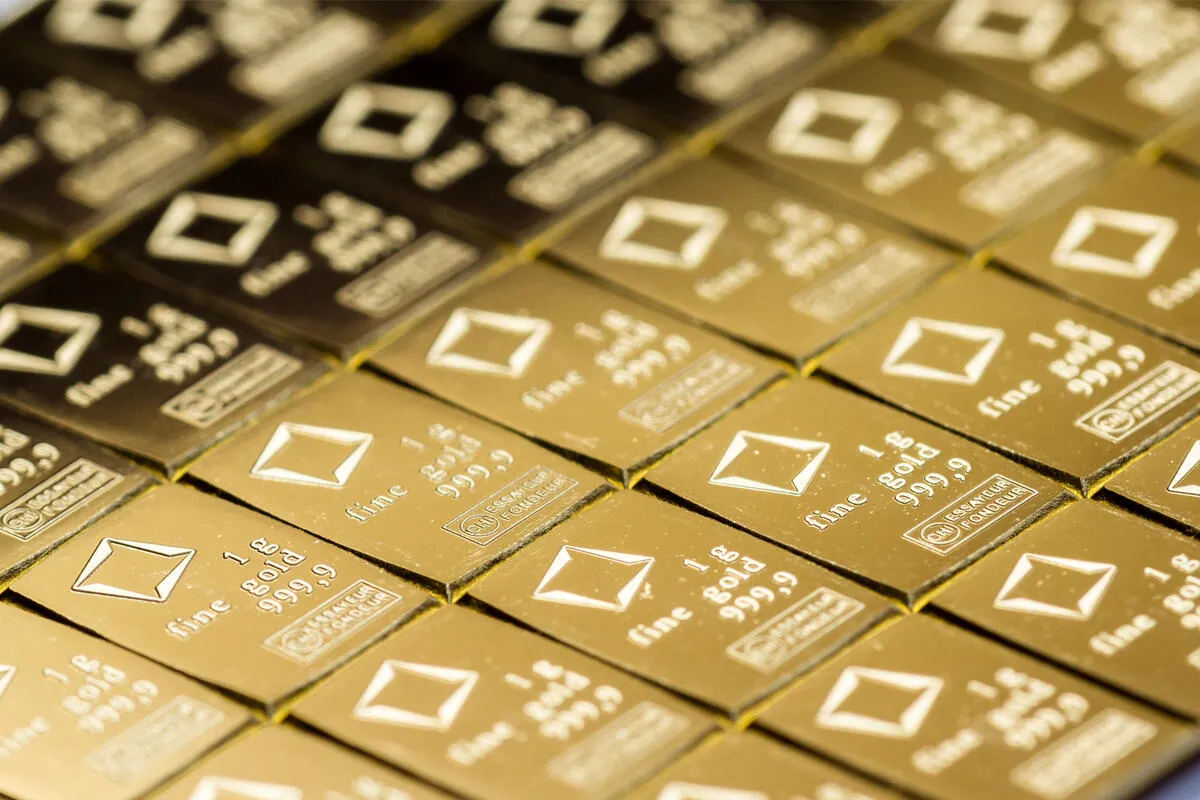

Gold (XAU) prices have been edged higher due to escalating geopolitical conflicts in the Middle East, prompting a surge in demand for safe-haven assets. As investors react to these tensions, gold offers a shield against market volatility.

Market Reaction to Economic Indicators

With U.S. inflation data looming, traders are scrutinizing the Fed's potential interest rate adjustments. Expectations of a 25-basis-point cut are prevalent, yet data trends could alter these perceptions.

Evolving Economic Landscape

The recent increase in U.S. Treasury yields suggests reluctance towards aggressive rate cuts. While labor market strength hints at economic resilience, adjustments in monetary policy could affect gold's positioning in the market.

Gold's Stability Amid Dollar Strength

Despite the strengthening U.S. dollar limiting gold's potential upside, demand remains strong due to ongoing geopolitical instabilities. Market participants believe gold will continue to trade within a narrow range, influenced by upcoming economic data.

Future Outlook for Gold Prices

As investors await crucial inflation data later this week, gold’s trajectory will largely depend on environmental factors, including U.S. economic indicators and Middle East dynamics. While gains may be capped by the dollar's strength, geopolitical strife could maintain gold’s relevance in investment portfolios.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.