Earnings Snapshot: Bank of New York Mellon Reports Profit Rise in Q3

Overview of Q3 Performance

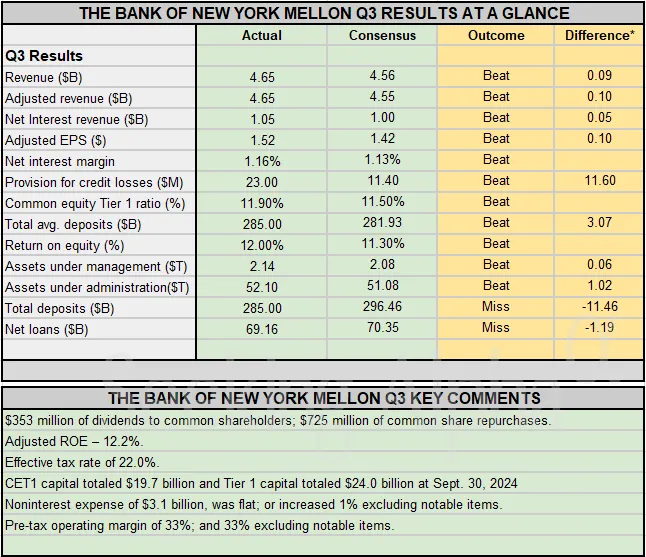

Bank of New York Mellon delivered strong earnings results for the third quarter, with profit exceeding analysts' expectations. The surge in AUC/A significantly contributed to this financial success, showcasing a robust performance in a competitive market.

Key Drivers of Growth

- Increased Assets Under Custody/Administration (AUC/A): The sustained growth in AUC/A has been a critical factor in enhancing profit margins.

- Cost Management Strategies: Effective cost controls played a vital role in maximizing profitability during this period.

- Market Demand: Overall demand for investment services remained strong, propelling growth.

Financial Implications

The rise in profit reflects positively on the bank's strategic positioning and serves as a beacon for future growth in the sector. Investors are keenly watching BNY Mellon's performance as it could signal broader trends in the financial markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.