Dailymail Money: CPI Inflation at 1.7% - Impacts on Money Bills and Beyond

Understanding CPI Inflation's Shift

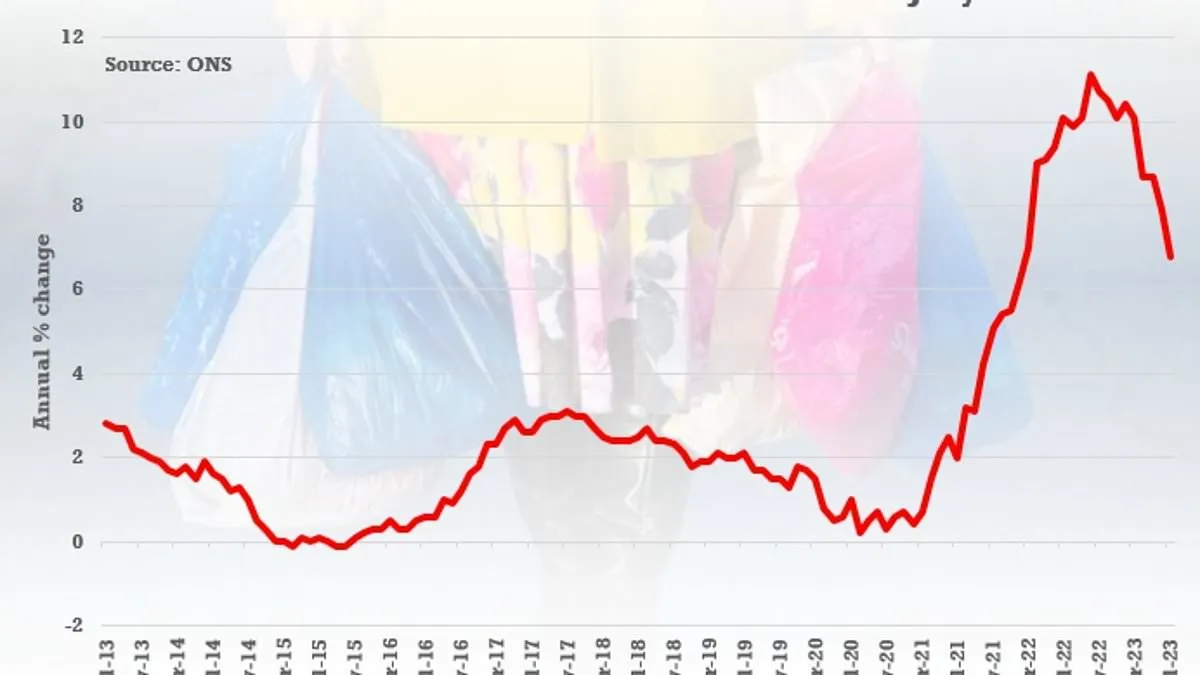

Recently reported CPI inflation has dropped to 1.7%, a figure notably below the Bank of England's target of 2%. This reduction indicates potential changes in monetary policy and financial strategies across the board.

Impact on Financial Decisions

The decline in inflation can potentially lead to adjustments in interest rates. As consumers and businesses reassess their money bills and spending habits, it's crucial to evaluate the likely outcomes:

- Interest Rate Hikes May Slow Down

- Increased Consumer Spending Potential

- Long-term Strategy Adjustments Required

Future Economic Landscape

This inflationary trend provides a glimpse into future financial market movements. Analysts predict significant shifts in economic dynamics as characterized by:

- A likely pause in rate hikes

- Market fluctuations based on Dailymail money insights

- Broader impacts on investments and savings

For deeper insights and expanding financial strategies, consider the implications of this inflation drop on your money bills.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.