Fiscal Debt Surge: Insights into the Global Economic Landscape

Examining the Escalating Fiscal Debt

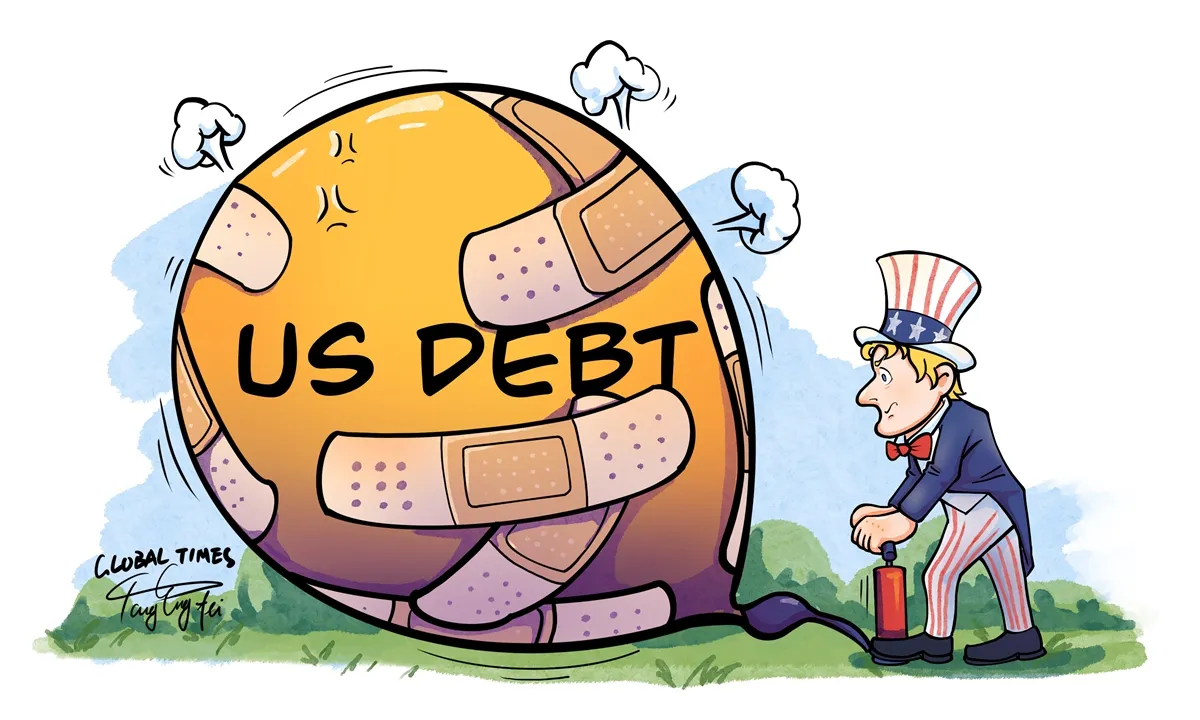

The U.S. federal budget deficit surged to $1.833 trillion for the 2024 fiscal year, marking the highest level outside of the COVID-19 pandemic. Investors across global markets are becoming increasingly anxious about the implications of this fiscal burden. As interest on the federal debt skyrockets, concerns about sustainability and economic growth intensify.

Impact on Global Markets

With rising fiscal debt, investors are scrutinizing the financial health of markets worldwide. The implications are profound:

- Interest Rates: Potential increases could affect borrowing costs.

- Investment Opportunities: Shifts in capital flows may emerge.

- Economic Stability: An essential concern for policymakers.

Conclusion: The Path Ahead

As the situation unfolds, stakeholders should closely monitor fiscal policies that affect economic forecasting and market trends. The urgency for effective risk management strategies has never been clearer.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.