Hexcel Stock Analysis: Understanding Valuation and Growth Drivers

Hexcel's Strong Earnings Performance

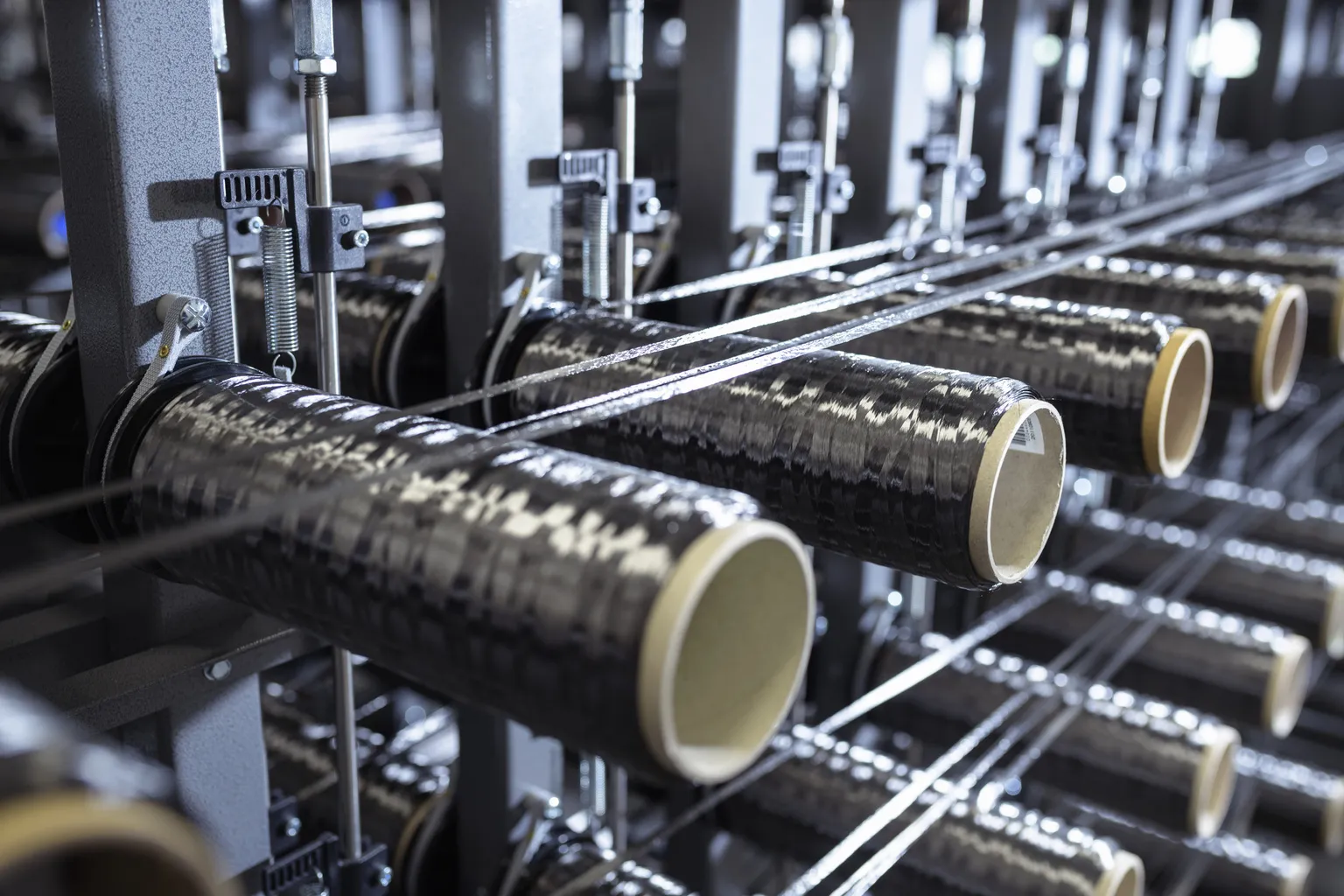

In the latest quarter, Hexcel (NYSE:HXL) showcased impressive earnings growth driven by a surge in demand from the aircraft manufacturing sector. Defense spending has further bolstered revenue, demonstrating the company’s strategic positioning.

Valuation Considerations

While many factors contribute to Hexcel's strong performance, its valuation has come under scrutiny. Analysts note that the stock's ratios indicate a slight stretching, suggesting investors must assess potential risks amid ongoing growth.

Market Trends Impacting Hexcel

- Growing Demand in Aerospace

- Increased Defense Spending

- Market Positioning within the Composite Materials Industry

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.