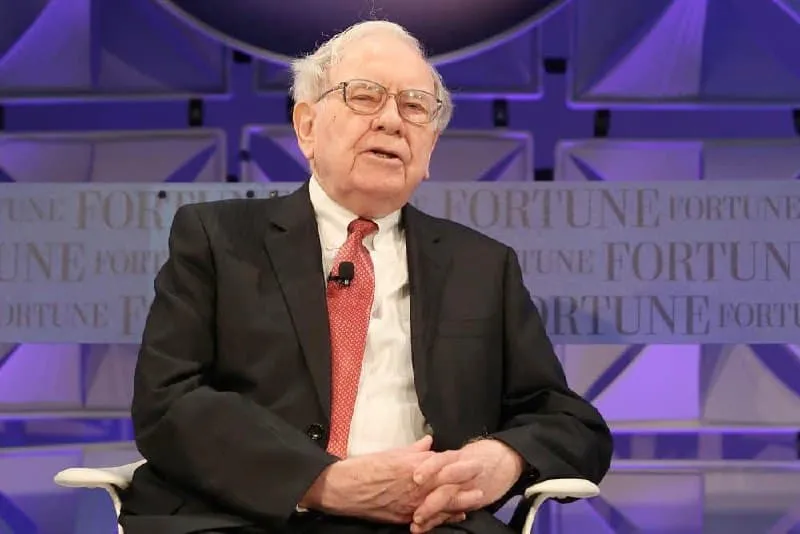

Warren Buffett's Major Apple Stock Downsizing and Its Implications

Warren Buffett's Massive Apple Stock Sale

Warren Buffett's Berkshire Hathaway (NYSE: BRK.A) has made headlines with a staggering reduction in its Apple (NASDAQ: AAPL) holdings, marking nearly $100 billion in sell-offs over two recent quarters. This pattern of divestiture signals shifts in Buffett's market outlook.

Significant Financial Moves

According to the latest earnings report, Berkshire reduced its stake from a peak of $174.3 billion to $69.9 billion by the end of September. This downsizing, nearly 25% of its shares, coincides with a wider liquidation of premium stocks, particularly reflecting a $9 billion reduction in Bank of America.

Market Reaction and Analyst Insights

- Buffett's action correlates with Apple trading at an elevated forward P/E ratio of 30.20.

- Speculations arise around potential capital gains tax impacts driving the divestiture.

- Despite these moves, Apple remains a cornerstone of Berkshire's portfolio.

Investing Strategy and Future Outlook

The pause in share buybacks and rising cash reserves highlight Berkshire's cautious approach amidst economic fluctuations. As they reassess tech investments, Buffett's decisions might influence market behavior significantly.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.