Arm Holdings Q2: Demand for Armv9 Surges, Company Faces Valuation Concerns

Arm Holdings Q2 Report: Strong Demand for Armv9

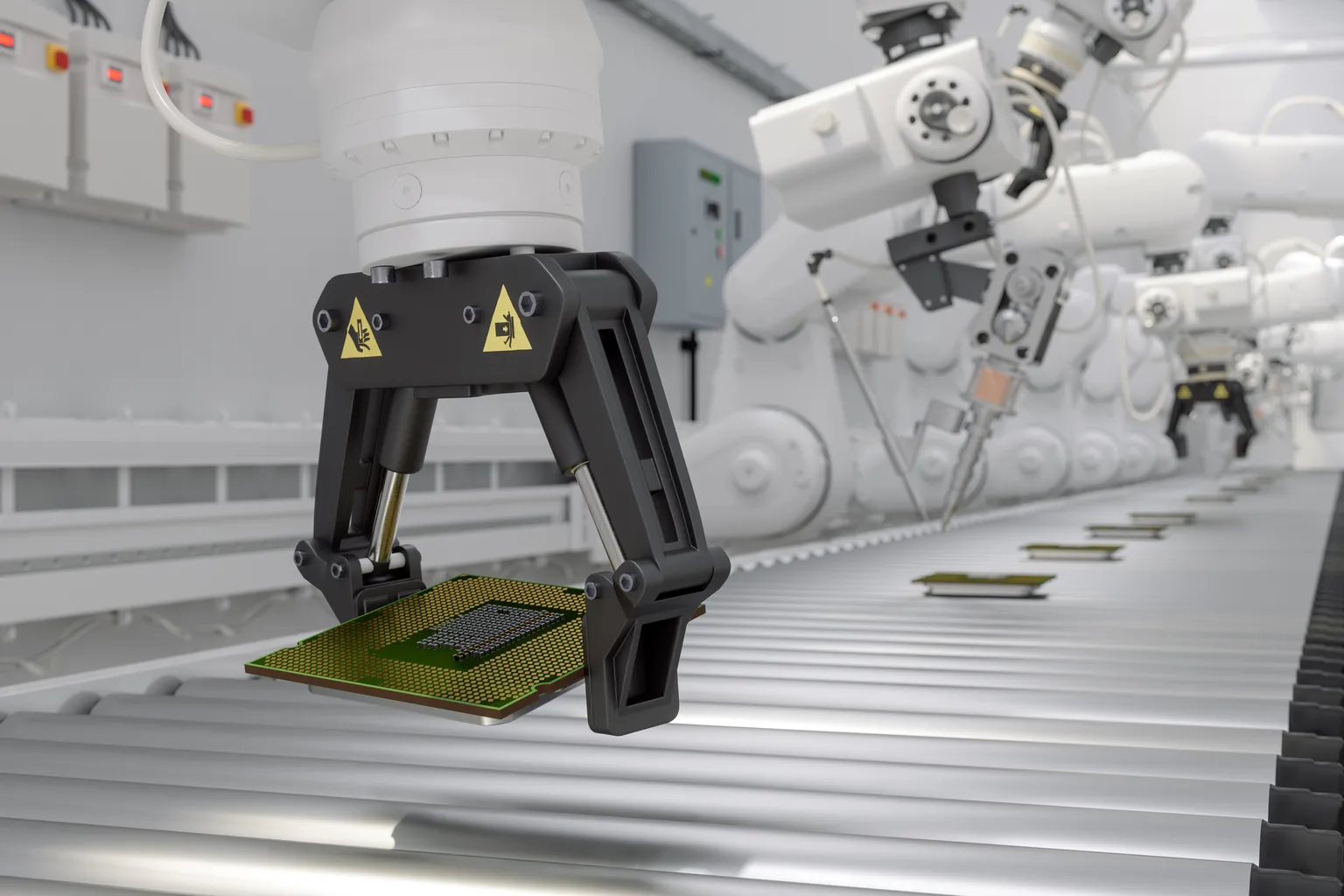

In the latest earnings release, Arm Holdings reported that demand for Armv9 chips has exceeded expectations significantly. This robust demand signals potential growth for the company in upcoming quarters. However, the concerns regarding stock valuation linger among financial analysts.

Valuation Analysis

Despite the promising growth trajectory in demand, ARM stock is viewed as overvalued. Current market evaluations place the company at a staggering 100x FY26 free cash flow, raising questions about future investment viability. Analysts recommend caution, suggesting that existing investors may need to reconsider their positions.

Implications for Investors

- High Demand: Positive trends are seen in chip production and sales.

- Valuation Concerns: The stock's price-to-earnings ratio is exceptionally high.

- Market Sentiment: Experts categorize ARM stock as a "Sell" given prevailing valuations.

In summary, Arm Holdings displays promising growth with elevated demand for Armv9 chips but remains a risky investment due to its high valuation metrics. Investors should stay informed about economic indicators affecting the tech industry.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.