Bitcoin ETFs Show Significant Outflows: Implications for Price Trends

Bitcoin ETFs and Market Trends

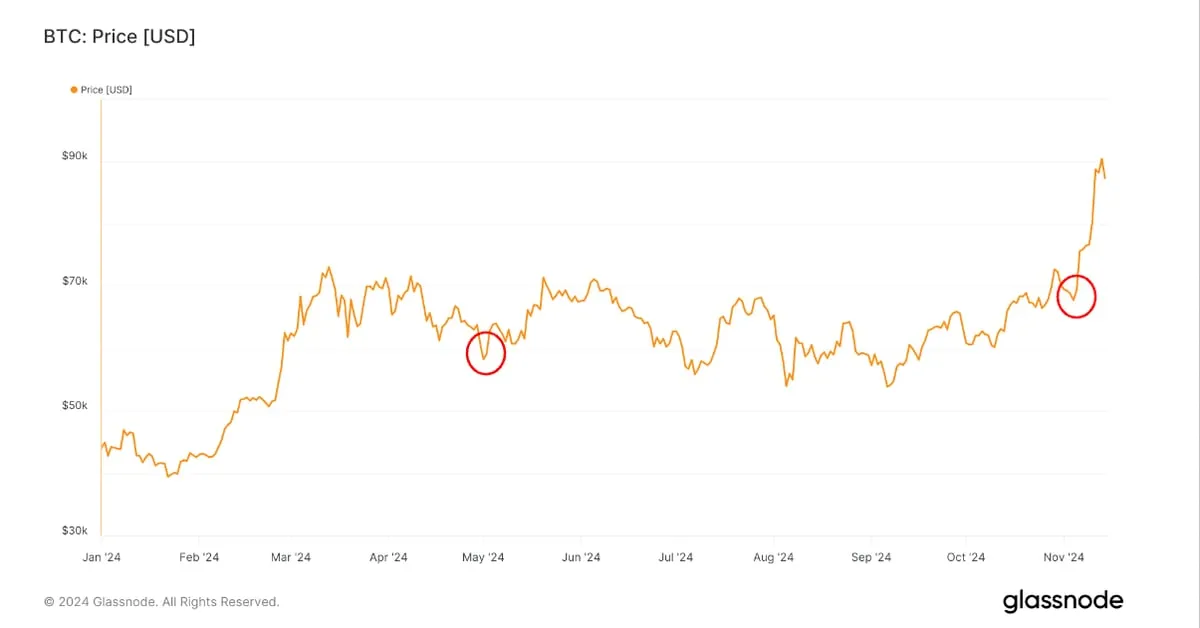

Bitcoin ETFs experienced notable outflows, registering the third highest since their launch. This development aligns with previous trends that often signal price corrections following significant withdrawals.

Understanding Outflows in Bitcoin ETFs

Such outflows indicate a shift in investor sentiment. Here’s a closer look:

- Market Reactions: Following outflows, many analysts observe adjustments in bitcoin pricing.

- Historical Context: Previous outflows preceded significant market bottoms, a trend worth monitoring.

- Related Assets: Ether ETFs could also be affected by these movements in the bitcoin ETF space.

Concluding Thoughts on Bitcoin and Ether ETFs

Interpretation of these outflows may present opportunities and risks for investors in both bitcoin and ether ETFs. Understanding these trends allows for informed investment strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.