Warren Buffett's Ulta Stock Decision: The Surge After Selling

Warren Buffett's Impact on Ulta Stock

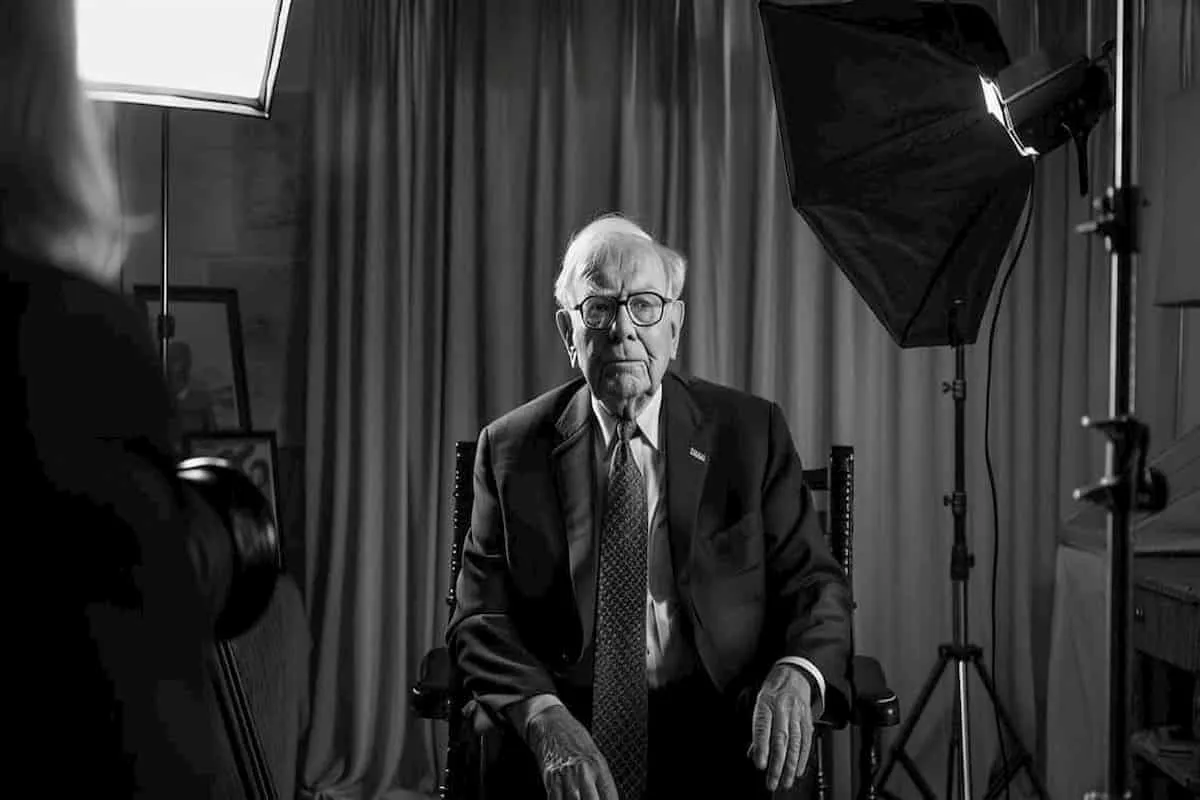

Warren Buffett, known for his prudent investment strategies, made a crucial decision recently by selling a significant portion of his holdings in Ulta Beauty (NASDAQ: ULTA). This has led to a surge in Ulta stock, raising eyebrows and prompting discussions among investors.

Buffett's Historical Approach to Stocks

Typically, Buffett seeks stocks with enduring competitive advantages, yet his recent actions are notable. In the last eight quarters, Berkshire Hathaway has been net selling stocks and has accumulated a record cash pile.

Ulta Beauty's Recent Performance

- Ulta stock traded at $375.25 recently, having bounced back by 9.36% in the last week.

- Despite being down 22.88% year-to-date, expectations are high for its upcoming earnings call.

Timing the Market: A Double-Edged Sword

Buffett's decision to reduce his stake in Ulta by 96% raises questions about his market timing. Essential to his investment philosophy is buying and holding, making this decision perplexing to many.

Looking Ahead

The upcoming earnings report on December 5 may provide crucial insights. Should Ulta outperform expectations, investors will wonder if Buffett's decision was a grave miscalculation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.