Cryptocurrency Predictions on Terra Classic (LUNC) Price by Year-End

Cryptocurrency Market Overview

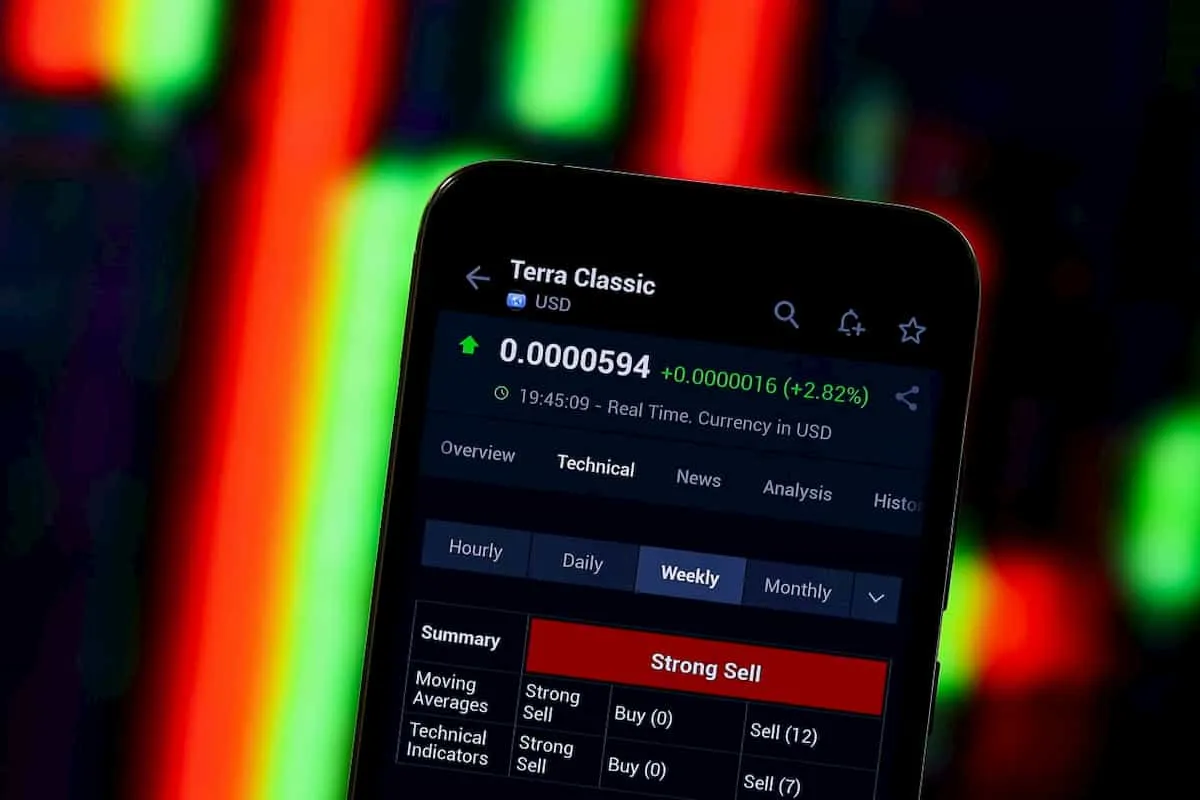

Cryptocurrency market predictions indicate a volatile outlook for Terra Classic (LUNC) as the year comes to a close. LUNC has struggled to maintain its price throughout 2024, despite various measures implemented to stabilize its value. Most notably, token burns aimed at reducing supply have influenced market perception.

Current Price Trends for LUNC

As of now, LUNC is trading at $0.0001225, reflecting a daily gain of 5.22% and weekly returns of 8.82%. Over the last month, traders have witnessed an impressive return of 32.68%, despite year-to-date losses of 11.61%.

AI Analysis of Bullish and Bearish Factors

Finbold consulted advanced AI models to gauge Terra Classic's price trajectory. GPT-4o highlighted bullish factors such as community support and recent developments like the launch of decentralized exchange Terraport. Positive sentiment in the market contributes to this bullish outlook.

- Efforts to reduce circulating supply

- Active community involvement

- Favorable market sentiment

Bearish Considerations for LUNC

Conversely, GPT-4o identified several bearish factors. Terra Classic’s history of volatility, reputational challenges from Terraform Labs’ founder, and the potential reintroduction of inflationary pressures through staking and minting mechanisms may hinder its growth.

- History of sharp price changes

- Institutional investor hesitance

- Regulatory scrutiny

2024 Price Predictions for Terra Classic

With both bullish and bearish factors at play, AI has outlined two distinct price targets for LUNC by year-end 2024:

- In a bullish scenario, LUNC could reach $0.000213, representing a 73.88% upside.

- If bearish trends dominate, prices could fall to $0.000096, reflecting a 21.63% decline.

It is crucial for traders to exercise caution, as advanced AI models, while insightful, cannot replace traditional analytical methods. Terra Classic remains a high-risk investment amidst more stable projects flourishing within the current market conditions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.