Bitcoin and Cryptocurrency Growth: Kiyosaki’s Portfolio Performance in 2024

The Performance of Kiyosaki's Portfolio

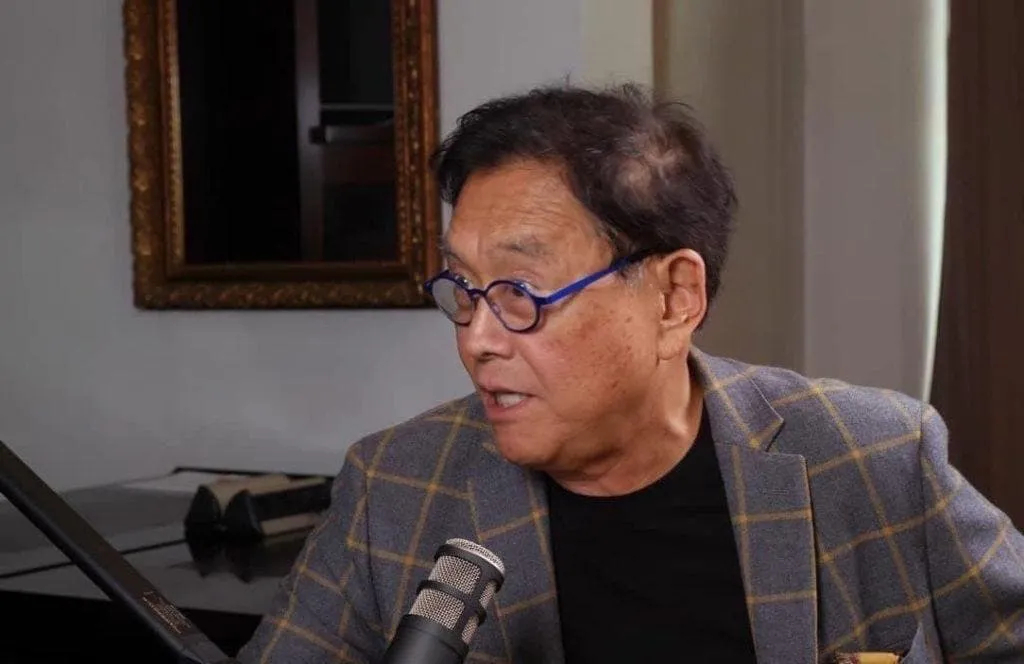

Robert Kiyosaki, the author of the personal finance book 'Rich Dad Poor Dad,' has consistently advocated for alternative investment products over traditional financial assets.

His recommended portfolio highlights precious metals such as gold and silver, alongside cryptocurrencies including Bitcoin (BTC) and Ethereum (ETH). Kiyosaki emphasizes caution towards fiat currency, labeling it as “fake money” headed for a crash.

Kiyosaki Portfolio 2024 Returns

In a year-to-date (YTD) analysis, Bitcoin has surged by 126.59%, peaking above the significant $100,000 mark. Meanwhile, Ethereum has grown by 47.49% and Solana by 86.49%.

- Gold: 27.35% increase

- Silver: 24.00% increase

Investing $1,000 equally among these five assets reveals:

- Bitcoin value now: $453.18

- Ethereum value now: $294.98

- Solana value now: $372.98

- Gold value now: $254.70

- Silver value now: $248.00

The total portfolio now stands at $1,623.84, showcasing a remarkable 62.38% gain in under a year.

Kiyosaki’s Perspective on Alternative Assets

With ongoing predictions of a global economic downturn, Kiyosaki argues that assets like Bitcoin, gold, and silver are vital for wealth protection. He foresees Bitcoin reaching up to $350,000 by 2025, reinforcing the notion that it's not too late to invest.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.