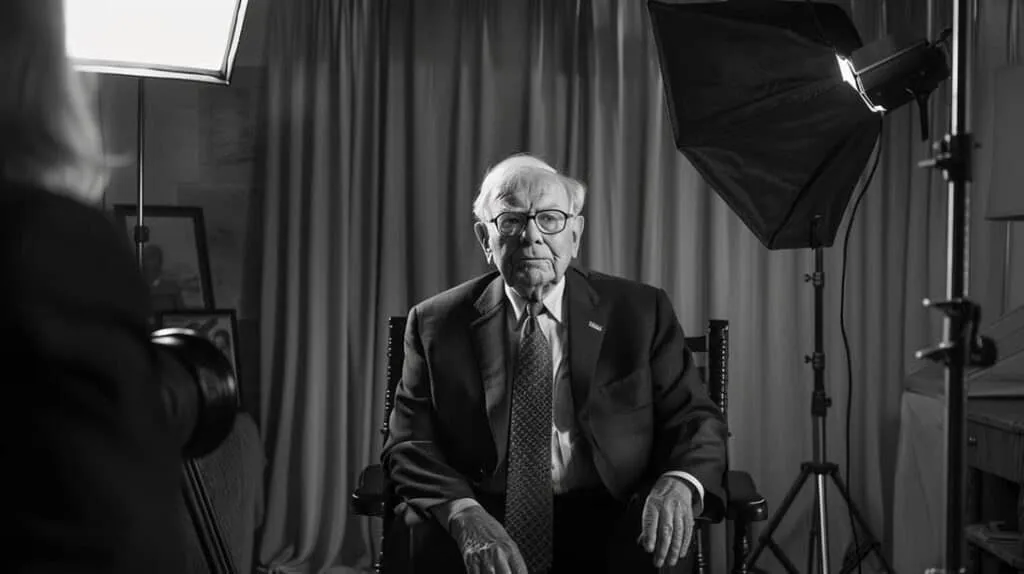

Nu Holdings: Understanding the 35% Stock Decline and Warren Buffett's Role

Nu Holdings Experiences Significant Stock Drop

Nu Holdings (NYSE: NU), the parent company of digital banking giant Nubank, has seen its stock tumble 35% from its mid-November peak of $15.94. Despite the decline, the company continues to capture a significant share of Latin America's unbanked population and maintains a market capitalization of $49.23 billion.

Macroeconomic Headwinds Affecting the Market

The sharp drop comes against a backdrop of macroeconomic headwinds in Brazil, including surging inflation, rising interest rates, and geopolitical uncertainties rattling investor confidence.

- Stock trading at $10.33, down 13% monthly.

- Growth in customer base amid financial pressures.

Growth Despite Challenges

Nu Holdings has firmly established itself in Latin America's banking sector, achieving impressive growth. In Q3 2024, the company added 5.2 million new customers, bringing its global total to 109.7 million, a 23% increase year-over-year.

- Stronghold in Brazil, expansions in Mexico and Colombia.

- 56% year-over-year revenue increase to $2.9 billion.

Lending operations expanded 97% year-over-year, and gross margins improved to 46%.

Stock Decline Factors and Analyst Perspectives

Nu Holdings' stock decline can be attributed to macroeconomic pressures, currency volatility, and Berkshire Hathaway's partial stake reduction. Analysts remain moderately bullish, highlighting the company's market position and growth metrics.

Investment Opportunities Amidst Decline

Despite the recent stock price drop, Nu Holdings exhibits strong financial performance, presenting a solid long-term investment potential in a growing fintech sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.