PBOC and China's Real Estate Sector: Addressing Structural Weaknesses

Understanding PBOC's Impact on China's Real Estate Challenges

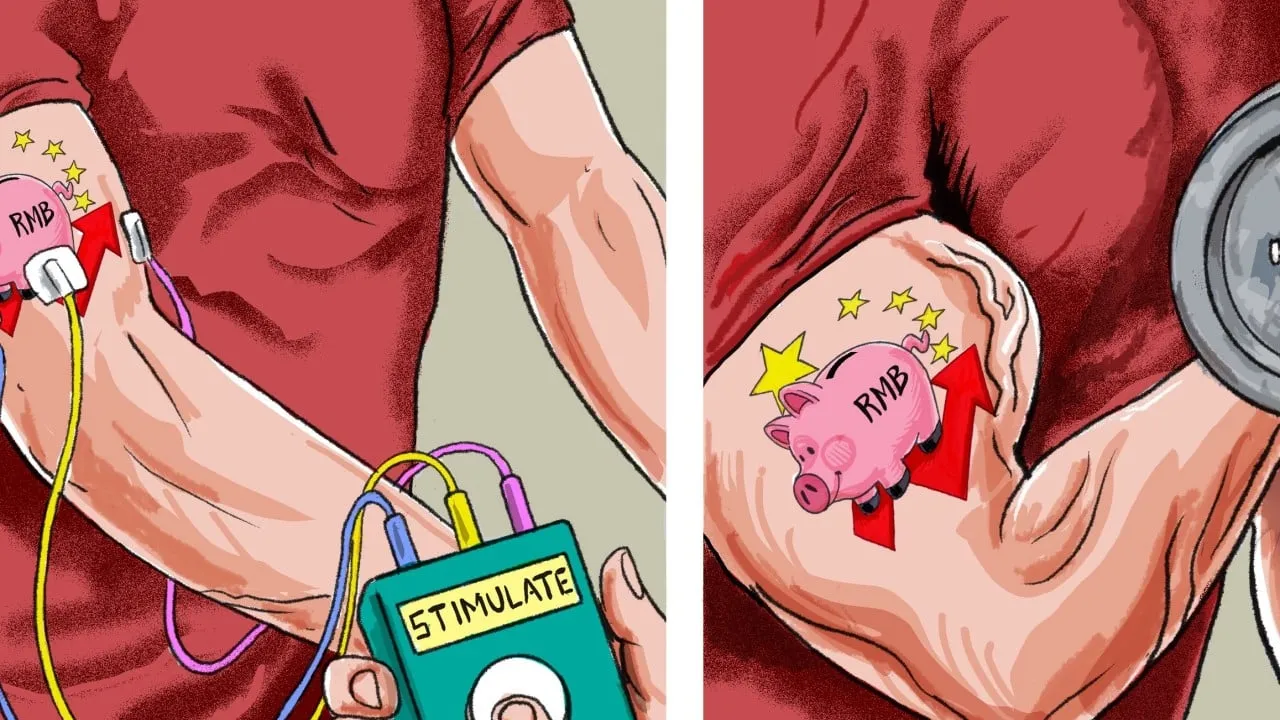

In the current economic landscape, the People’s Bank of China (PBOC) is making significant efforts to address the challenges facing the real estate sector. With a target GDP growth of 5%, this year's fiscal stimulus plan aims to enhance investment and consumption.

Evaluating Income Inequality and Structural Weaknesses

Income inequality remains a critical issue that exacerbates China's economic challenges. The National Development and Reform Commission has highlighted the need for reforms to improve social safety nets.

- Addressing deflationary pressures is crucial, as industrial overcapacity contributes to economic sluggishness.

- Confidence among business leaders has waned, as per a survey by The Conference Board, signaling the need for firm action.

Fiscal Responses and PBOC Strategies

In response to ongoing economic pressures, the PBOC has signaled a shift towards a more moderately loose monetary policy. The proposal includes:

- Potential interest rate cuts to stimulate borrowing.

- Lowering banks' reserves to increase liquidity.

- Increasing financial supply to stimulate demand.

Infrastructure investments are also prioritized, particularly in critical sectors like technology and agriculture, aiming to bolster consumption.

Challenges Ahead: A Focus on Debt Sustainability

However, as government bonds are purchased to finance expenditures, questions arise regarding debt sustainability in the long term. Addressing oversupply in the real estate sector is paramount for economic recovery.

Global Trade Alignment and Future Outlook

Finally, international relations pose additional challenges, with Beijing seeking to align with global trade norms while bolstering local demand. The balance between fostering foreign investment and maintaining national security will determine the success of these reforms.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.