Bridgewater Associates Adjusts Portfolio: Alibaba Holdings Reduced, Li Auto and Baidu Boosted

Bridgewater Associates Restructures Holdings

Bridgewater Associates has made significant shifts in its investment portfolio, primarily reducing its holdings in prominent US-listed Chinese companies such as Alibaba Group Holding and Trip.com Group. An analysis of its latest 13F filing indicates these changes are part of a broader strategy amid Beijing's stimulus initiatives and the rise of artificial intelligence technologies spearheaded by DeepSeek.

Strategic Cuts and Gains

- Alibaba stake reduced by 50%, along with other major cuts in Tencent Music and iQiyi.

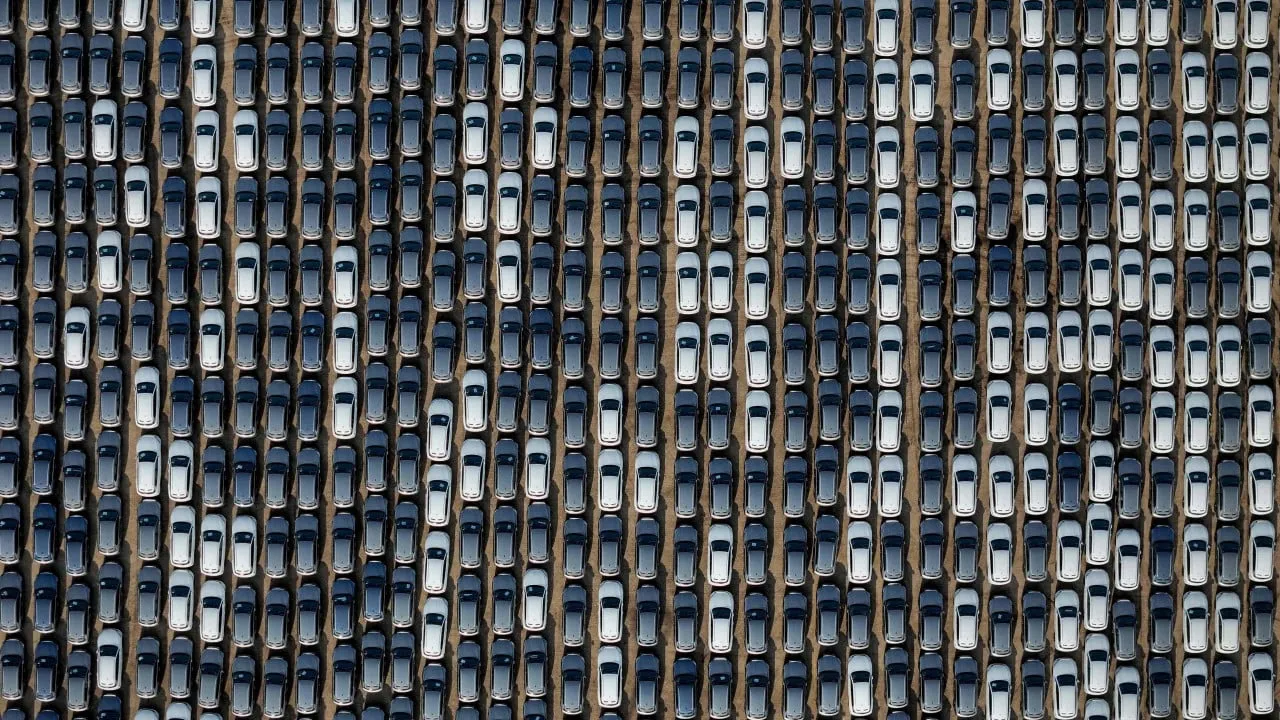

- In contrast, investments in electric vehicle manufacturers like Li Auto and search engine Baidu were increased significantly.

- A notable 131% increase in shares for Li Auto and a 72% boost for Baidu showcased the hedge fund's shift towards promising sectors.

Boosting Positions in Evolving Markets

While the overall investment focus shifted, Bridgewater’s stake in Nio increased by 29%, which unfortunately did not yield the desired results as the stock faced a downturn. The firm now holds a portfolio valued at over $21.8 billion, featuring stakes across a variety of sectors.

Market Insights and Future Directions

This reallocation comes as the MSCI China Index reported remarkable growth amidst China’s stimulus efforts. As highlighted by co-CIO Karen Karniol-Tambour, ongoing ideological differences could pose challenges ahead for the Chinese market dynamics as they align on future strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.