Berkshire Hathaway Inc Reports Earnings Surge: A New Investment Strategy for Wall Street

Fourth Quarter Earnings Report

Berkshire Hathaway Inc has reported a staggering 71% surge in fourth-quarter earnings. This remarkable increase is attributable to effective investment strategies and strong market performance. The company’s cash hoard ballooned to a record $334 billion, showcasing its robust financial health.

Market Reaction and Future Outlook

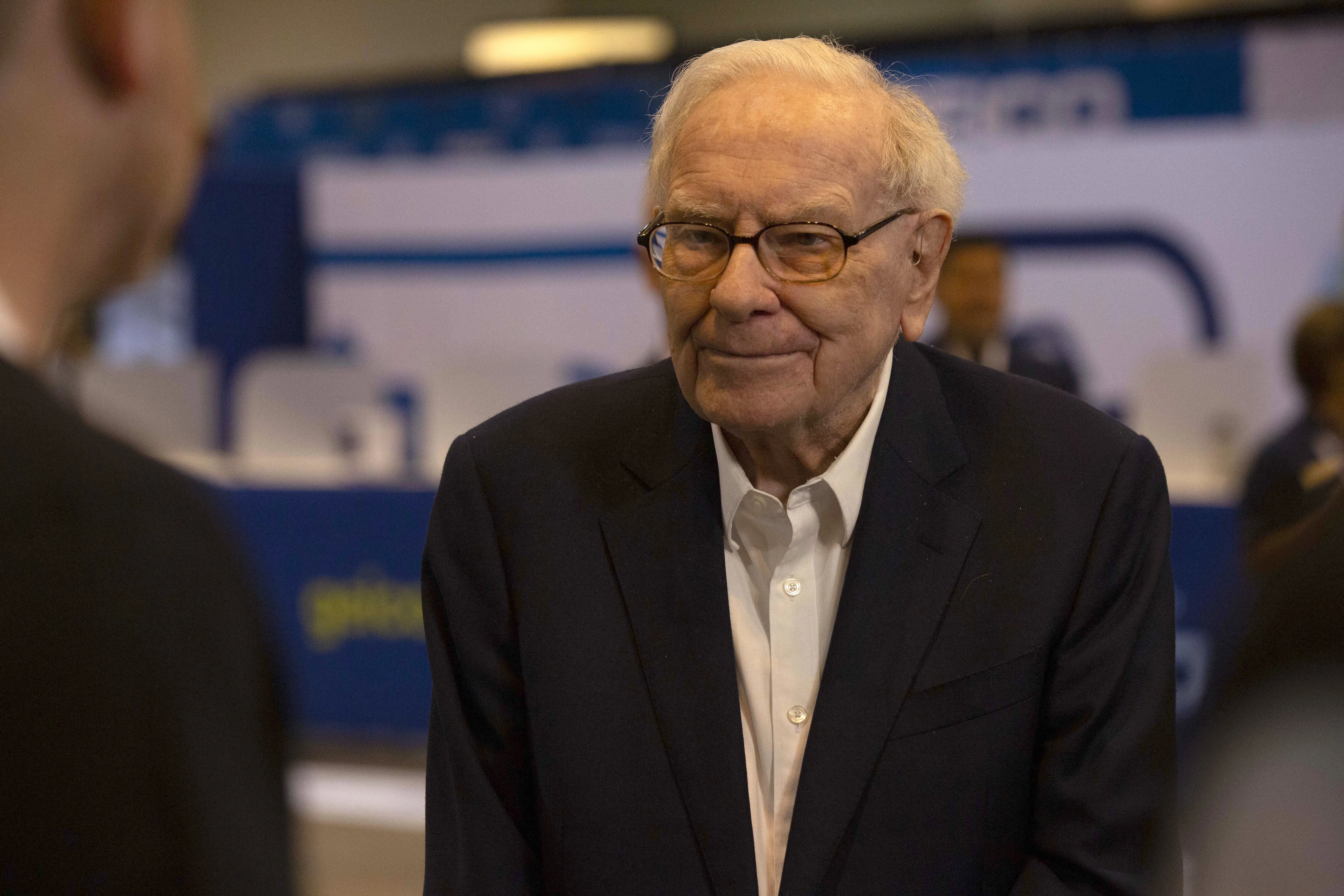

The market responded favorably to the announcement, with Berkshire's Class A shares soaring more than 25% in 2024. Investors are keenly observing how this financial powerhouse, under the guidance of Warren Buffett, will navigate the evolving landscape of stock markets.

- Strong earnings growth can influence investment strategies.

- Cash reserves provide flexibility in market investments.

- Wall Street looks to Berkshire for leadership.

- Investors should analyze Berkshire’s new investment strategies.

- Consider the implications for the overall market.

- Stay updated on future earnings reports from Berkshire.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.