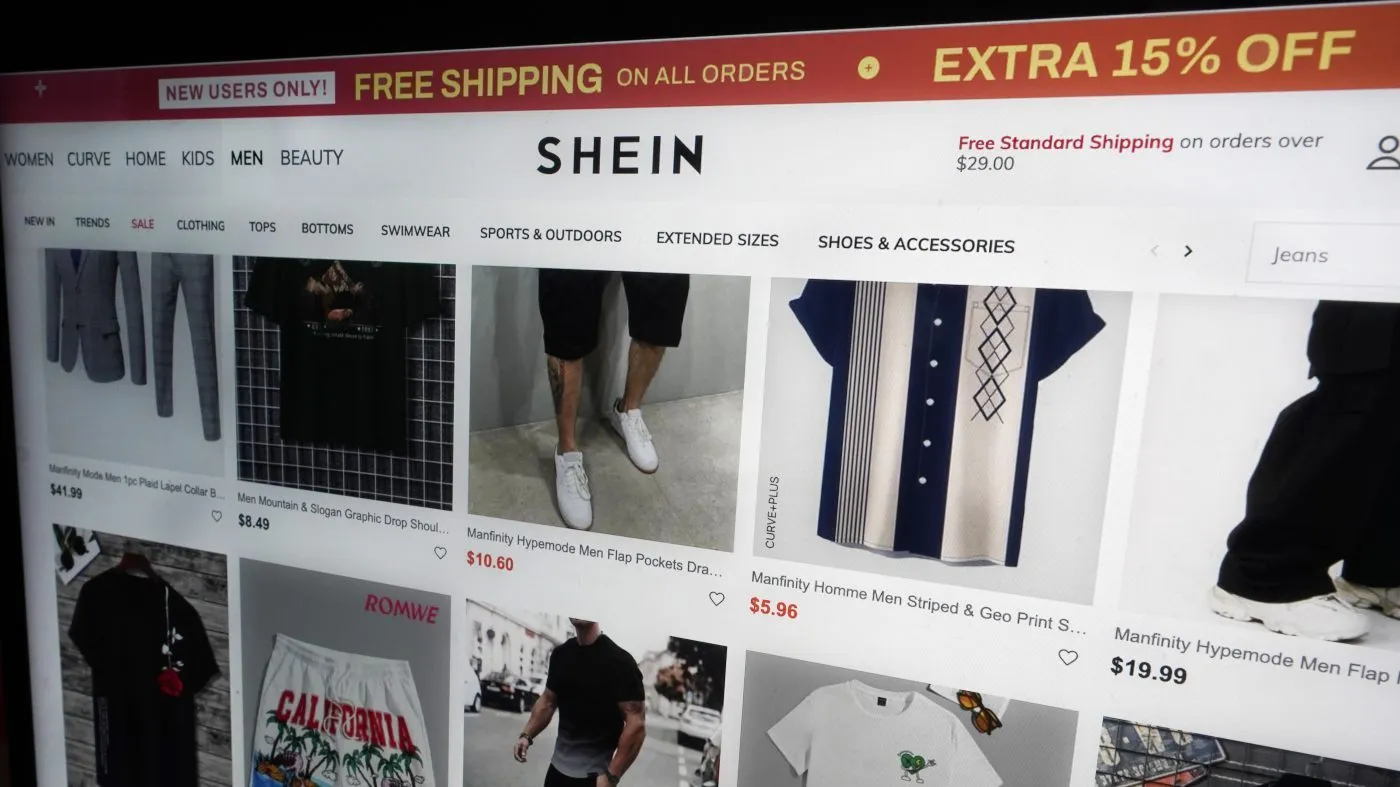

Trump's Rule Change Could Increase Costs for Shein and Temu Customers

Overview of Trump’s Rule Change

Trump's recent executive order terminates the de minimis exemption, which allowed low-cost packages from China and Hong Kong to enter the U.S. without tariffs on shipments valued at $800 or less. This pivotal rule end could revolutionize the pricing landscape for budget retailers like Shein and Temu.

Impact on Consumers

The rule change could lead to a substantial price increase for consumers shopping at these platforms. Effective May 2, imports will be subjected to a tax rate of either 30% of their value or $25 per item, rising to $50 after June 1. This modification comes at a time when the demand for e-commerce is skyrocketing.

- The de minimis exemption has surged; nearly 1.4 billion shipments utilized this pathway last year.

- Packages from China constitute approximately 60% of these entries, raising numerous concerns.

Legislative Background

Both major political parties have recognized the flaws in the de minimis provision, associating it with increased drug smuggling. Despite past administration efforts to modify this, recent moves by Trump signify a more drastic approach.

Broader Implications for Retailers

While this affects primarily Chinese goods, other international shipments could soon follow suit. Should the loophole close globally, U.S. consumers might face steep costs, estimated between $11 billion to $13 billion.

- Retailers are wary; some may halt shipping low-cost items, leading to delivery delays.

The effects of this reform extend far beyond just dollar amounts; it marks a significant shift in import policy affecting low-income consumers and altering the competitive landscape for affordable goods.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.