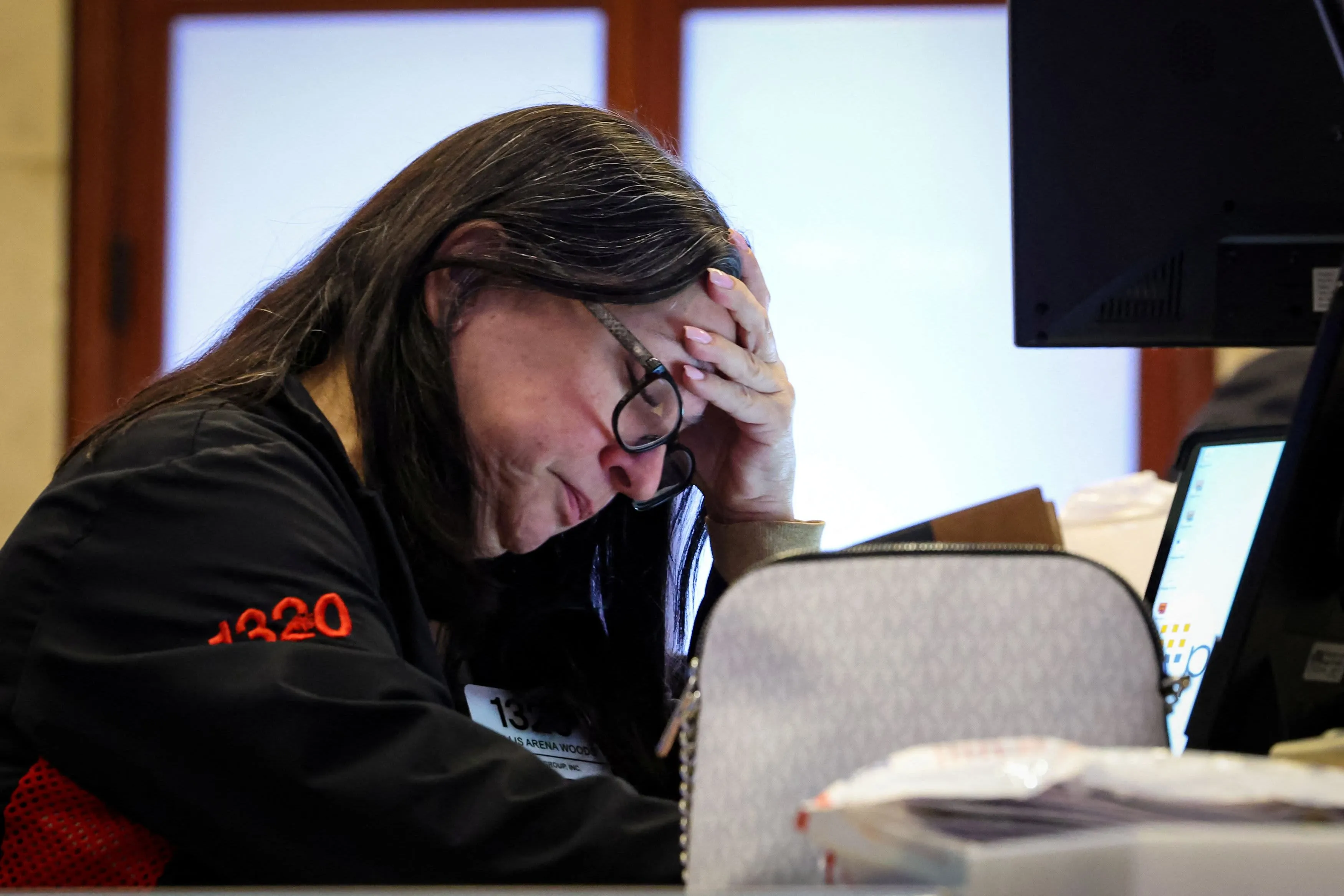

Trump's Tariffs: A Stagflationary Shock to Investment Strategies in Stock Markets

Trump's Tariffs Impact on Investment Strategies

Trump's tariffs are now framing a new chapter for investment strategies, presenting themselves as a stagflationary shock in stock markets. Analysts are observing that these measures may lead to higher inflation alongside lower GDP. With a focus on significant players such as Nvidia Corp, Apple Inc, and Amazon.com Inc, investors must recalibrate their approaches to align with these economic shifts.

The Magnificent 7 and Their Role

- Alphabet Inc continues to innovate despite challenges.

- Meta Platforms Inc adapts strategies to sustain growth.

- Tesla Inc remains a focal point in evolving markets.

- Microsoft Corp adapts investment strategies to cater to industry demands.

As business news unfolds, the CNBC Magnificent 7 Index signifies crucial market insights. Investors should be prepared to adjust their investment strategies accordingly.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.