Earnings Recovery Potential Dims in China Due to Trade Crisis, Analysts Say

Earnings Recovery Outlook at Risk

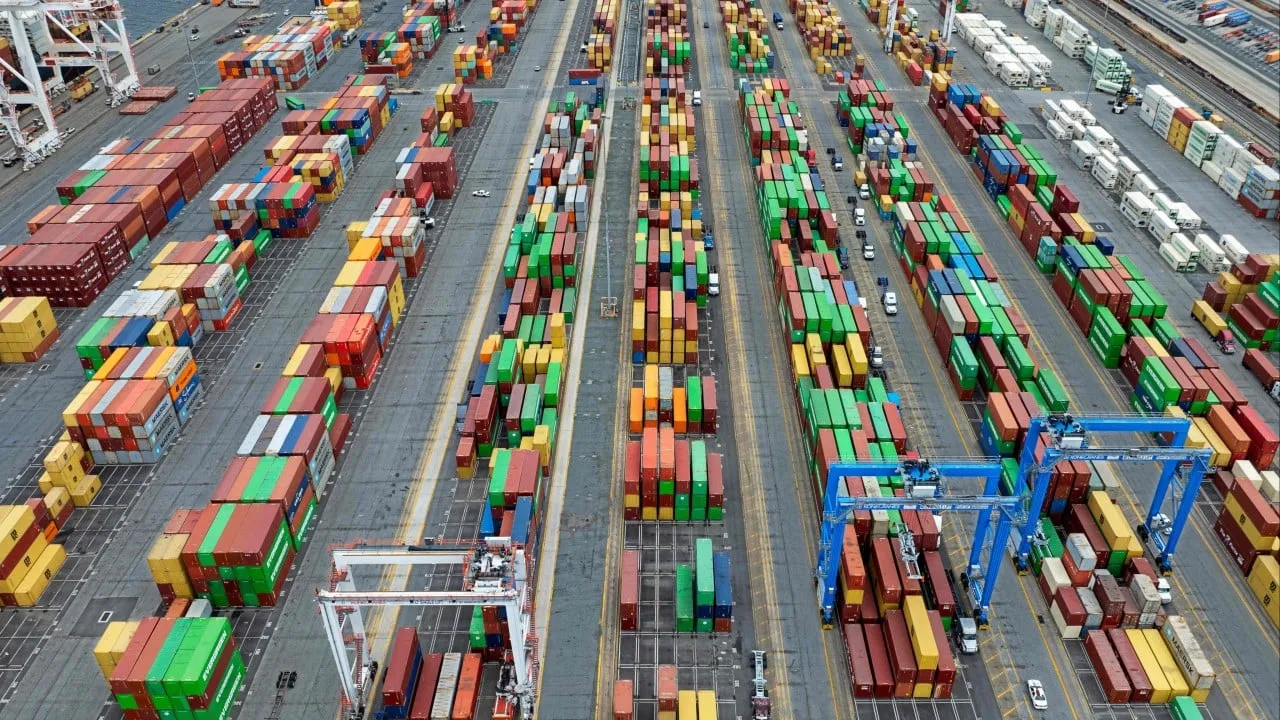

As the trade crisis continues, the earnings recovery potential for China stocks is under scrutiny. Analysts from Morgan Stanley express concerns that tariffs imposed by the Trump administration coupled with retaliatory measures from China could significantly dampen overseas demand for Chinese products, forcing companies to rely on hesitant domestic consumers for revenue.

Corporate Earnings Impact

The analysts foresee a notable impact on earnings visibility starting from the second quarter of the year, assuming no escalation in trade hostilities or robust support from Beijing. Despite the MSCI China Index stocks performing in line with expectations in the fourth quarter, challenges lie ahead.

- The tariff tensions introduce uncertainty around future earnings growth.

- Goldman Sachs has already adjusted estimates for Chinese corporate earnings and overall GDP.

Market Responses

Recently, both CSI 300 Index and Hang Seng Index displayed volatility, reflecting investor concerns over the trade situation. The deflation scenario in China complicates matters, as manufacturers may shift focus to domestic sales in response to tariff pressures.

- China's consumer prices decreased by 0.1% year-on-year, with producer prices also falling significantly.

Morgan Stanley suggests investors consider defensive stocks, emphasizing the importance of adjusting portfolios amidst potential market disturbances.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.