SALT Deduction Cap Proposal Sparks Debate Among House Lawmakers

SALT Deduction Cap Proposal Under Fire

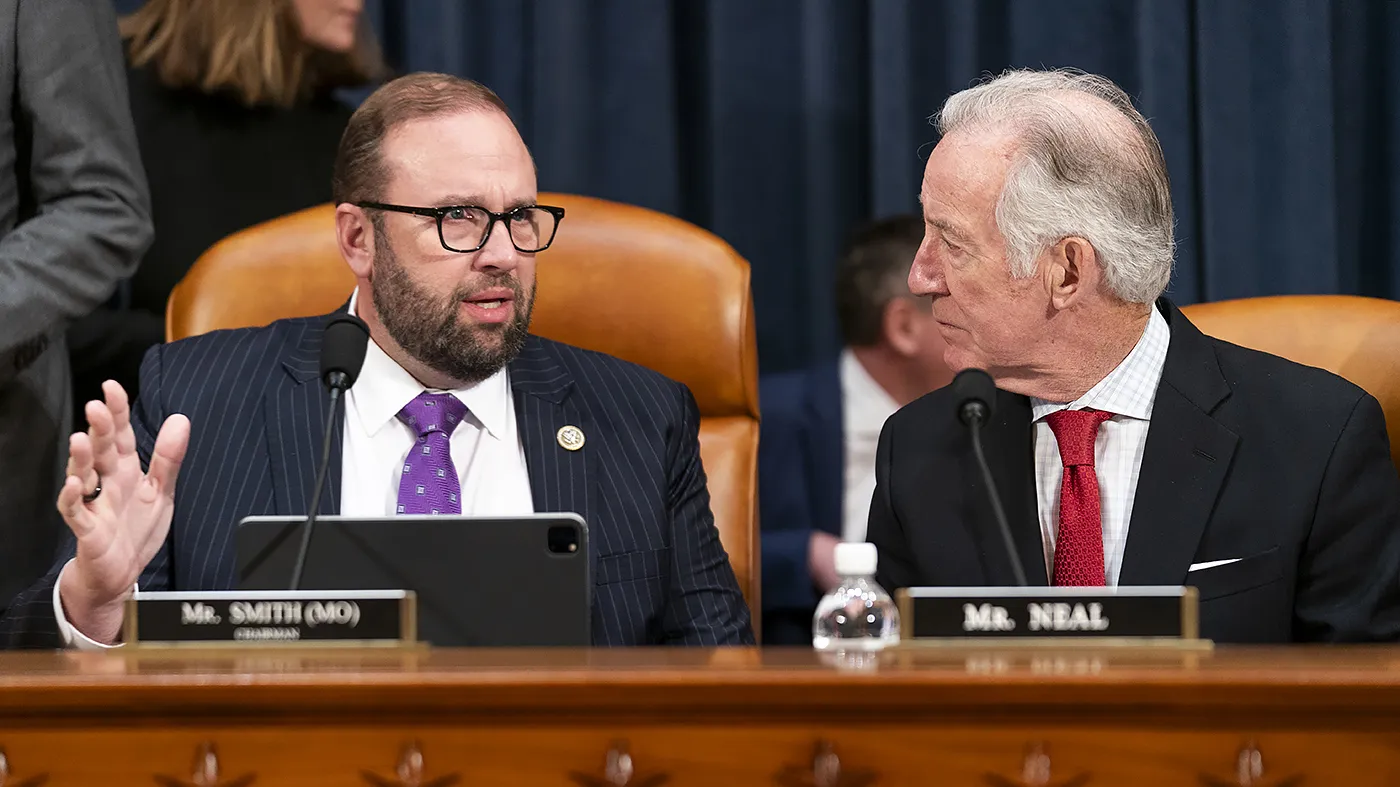

The House Ways and Means Committee is evaluating a plan to enhance the state and local tax (SALT) deduction cap by $30,000 for single and joint filers with incomes below $400,000, despite significant pushback from influential lawmakers who denounced the measure last week.

Contention Among Lawmakers

A recent meeting led by Speaker Mike Johnson (R-La.) included SALT Caucus members and committee lawmakers, aimed at reaching consensus on this divisive issue ahead of the committee's markup scheduled for Tuesday at 2 p.m.

- Discussion centered on various figures, but no agreement was reached as of yet.

- Johnson indicated that the dialogue was productive and further discussions are ongoing.

- Among the suggested numbers, a $62,000 cap for single filers and a $124,000 cap for joint filers, to be indexed for inflation starting in 2025, was proposed.

Resistance from SALT Caucus Members

Despite ongoing deliberations, the proposed $30,000 cap, which is three times the current limit of $10,000, is already facing vehement opposition. SALT Caucus members have expressed that this figure will not garner their support.

Recent statements from SALT Caucus members highlight their dissatisfaction, emphasizing that the unilateral nature of the proposal could jeopardize President Trump's legislative agenda.

Longstanding Debate on SALT Deduction Cap

The discourse surrounding the SALT deduction cap has historically divided the Republican Party, with moderates from states like New York and New Jersey advocating for an increase while conservatives aim to maintain fiscal discipline amidst growing deficits.

As the situation develops, SALT Caucus members remain firm in their demands for adequate relief for their constituents, indicating a turbulent road ahead for this legislative proposal.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.