Tax Planning: How the House Republican Tax Bill Benefits Wealthy Individuals

Tax Planning and the New House Republican Tax Bill

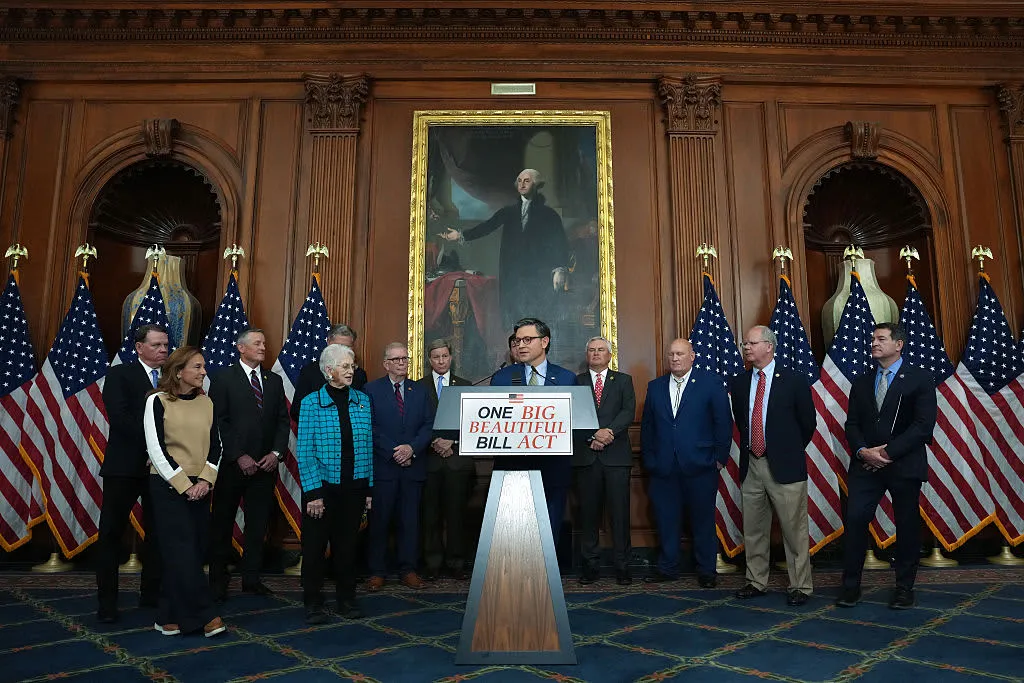

A recent bill focused on government taxation and revenue has gained attention for its implications in personal finance. The legislation, backed by House Republicans, funnels substantial financial perks to affluent individuals while leaving lower-income earners at a disadvantage.

Key Features of the Tax Bill

- Tax Breaks for the Wealthy: Significant reductions in tax rates for high-income earners.

- Impact on Middle and Low-Income Families: Many will experience increased tax burdens instead.

- Political Ramifications: The legislation has ignited heated debates in the political arena.

Understanding the Broader Implications

This legislation shines a light on the current political environment and its potential effects on business news and legislation. With the focus on tax planning, stakeholders are encouraged to assess their personal finance strategies moving forward in response to these developments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.