Exploring the Resilience and Potential Growth of PepsiCo Stock

Exploring the Resilience of PepsiCo Stock

When it comes to long-term investments, PepsiCo stands out as a Dividend King known for its stability and returns.

The Strong Business Model

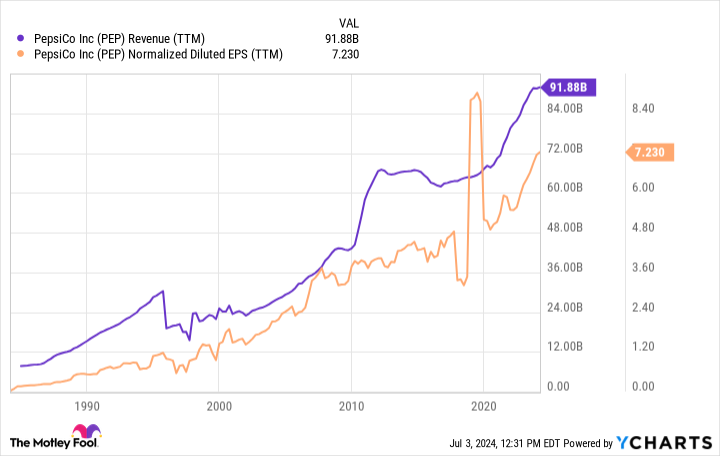

With a diversified portfolio and consistent revenue streams, PepsiCo shows strength even in challenging market conditions.

Essential Factors for Investors

- Steady Dividend Growth: Investors can benefit from the reliable dividend payouts that reinforce PepsiCo's appeal.

- Market Performance: PepsiCo's stock performance remains resilient, reflecting its strong market position.

- Strategic Advantages: The company's strategic initiatives fuel growth and sustainability in the competitive market.

In conclusion, PepsiCo stock is positioned as a valuable investment choice for long-term growth and stability in your portfolio.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.