Gold Price Decline: Examining a Potential Pullback or Bearish Reversal

Gold Price Movement

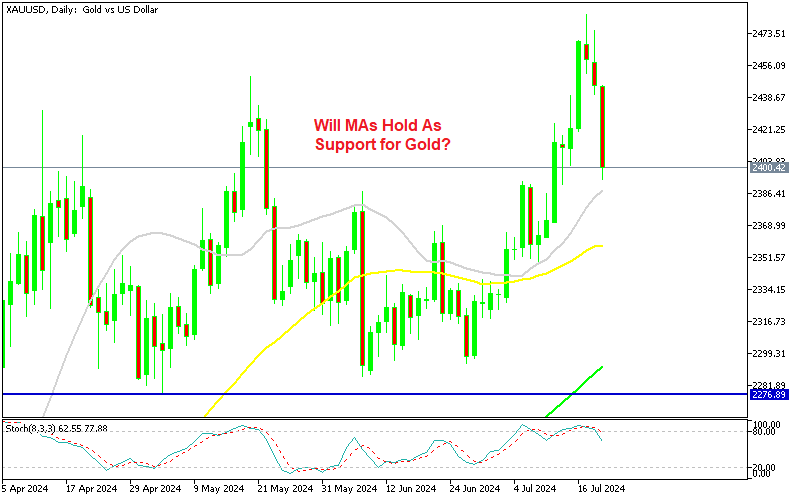

The recent drop in gold prices has caught the attention of investors. On Friday, the price accelerated its decline, printing a low of $2,393.77 and closing at $2,400. This decline follows a remarkable rally that took place in July, which raises questions about the current market dynamics.

Market Implications

- Significant rally prior to decline in July

- Recent lows hovering around $2,400

- Concerns among investors regarding a reversal

As the gold market adjusts to this recent price action, investors need to consider the broader implications and whether this pullback represents a typical correction or hints at a more serious bearish reversal.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.