Understanding Nvidia's Historical Recovery Patterns After Significant Pullbacks

Nvidia's Performance History

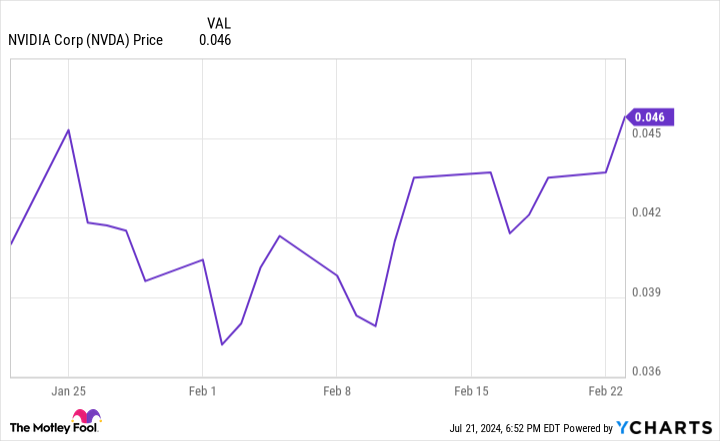

Nvidia has a 100% success rate for rebounding after stock pullbacks of over 10%. Historically, the company has shown resilience, often bouncing back strongly.

Implications for Current Investors

- Investors are closely monitoring the stock's performance after this recent pullback.

- Understanding past recovery patterns is crucial for making informed decisions.

Conclusion

While Nvidia's historical performance suggests a favorable outlook, market dynamics may introduce new variables. Investors should proceed with caution and consider the unique context of the current economic environment.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.