In-Depth Analysis of Fair Isaac's Short Interest

Understanding Fair Isaac's Short Interest

Fair Isaac Corporation, ( FICO) has witnessed a notable uptick in its short interest, which is a strong indicator of trader sentiment in the financial markets.

Current Statistics

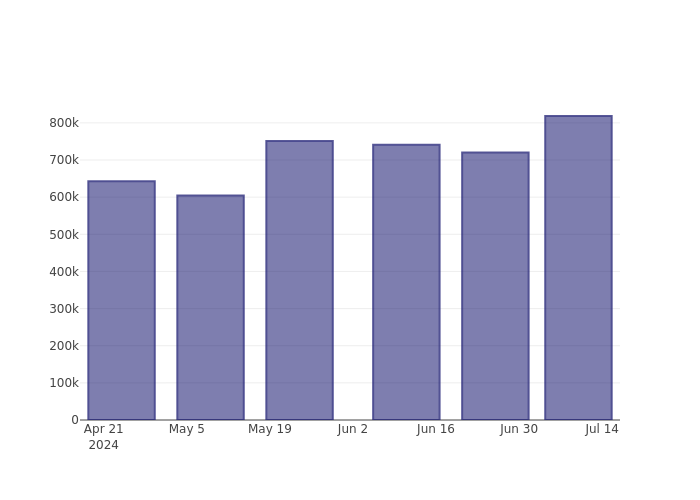

- Short Interest Increase: 13.51% since the last report.

- Shares Sold Short: 818,000 shares.

- Percentage of Float: 4.37% of all tradable shares.

- Days to Cover: Approximately 4.07 days based on trading volume.

Significance of Short Interest

Short interest represents the total shares that traders have sold short but have not yet covered. Traders aim to profit from a decrease in stock prices, making this metric crucial for assessing market trends.

Conclusion

With the rise in Fair Isaac's short interest, investors should closely monitor this indicator as it may suggest underlying market strategies and future price movements.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.