ASML Holding NV: UBS Upgrades Investment Strategy and Signals Inflection Point in Stock Markets

ASML Holding NV Sees Shift in Stock Markets Following UBS Upgrade

On the financial front, ASML Holding NV has captured attention in the stock markets as UBS lifted its rating from neutral to buy. This significant move points to a promising investment strategy poised for remarkable growth.

Why UBS Upgraded ASML

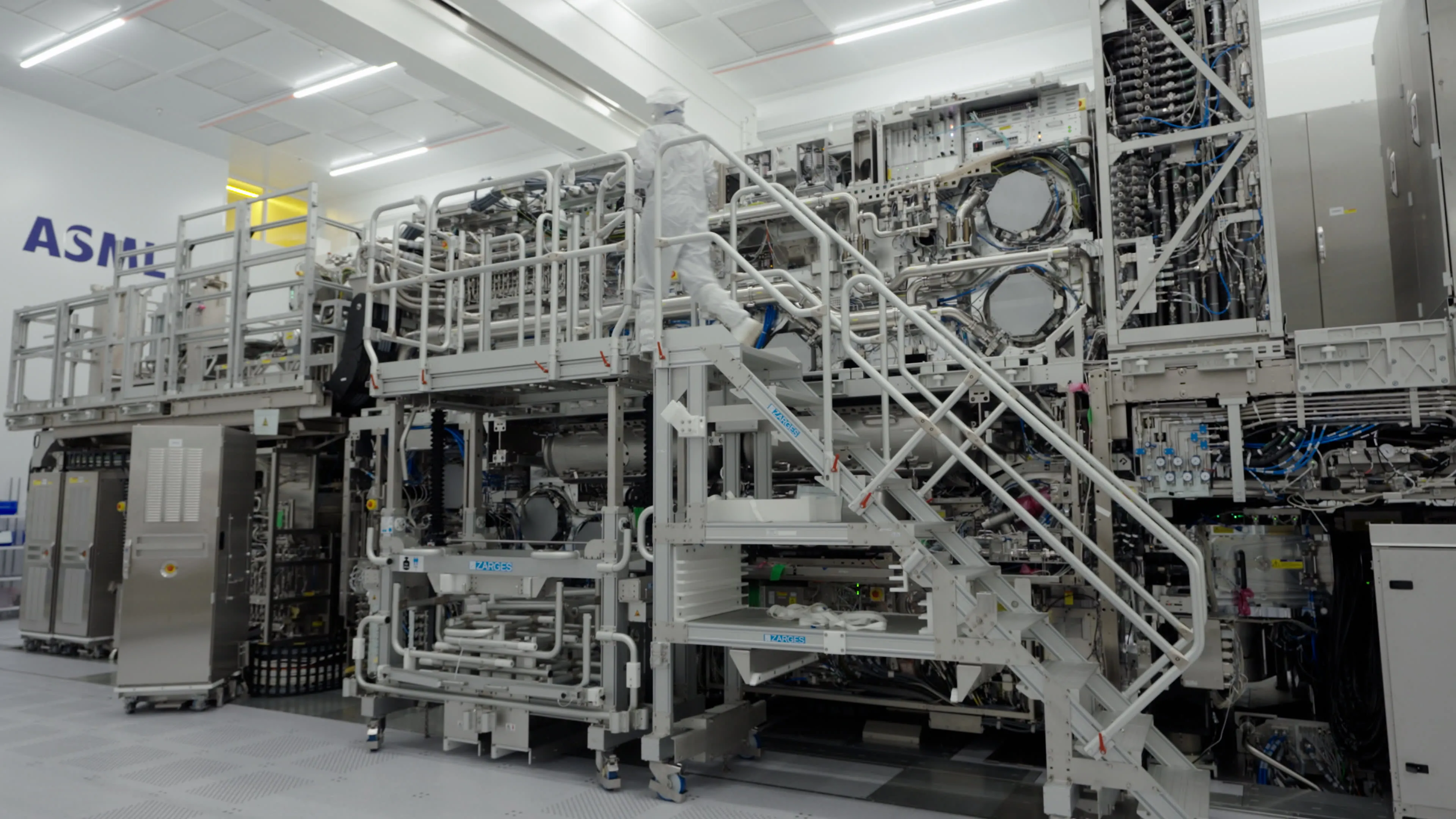

UBS's optimism is fueled by ongoing developments in ASML's lithography business, which underpins the demand for advanced chip-making technologies. The firm believes ASML is approaching a critical inflection point that will enhance its competitive edge.

- Key Factors Behind Upgrade:

- Positive market trends in semiconductor manufacturing

- Increased investment in technology innovations

- Growing demand for chips globally

Implications for Investors

The upgrade suggests that ASML's stock could reflect superior performance amid evolving challenges in the industry. Investors may want to reassess their positions in light of this news. The outlook on ASML is brighter as analysts expect the company to capitalize on its strategic advantages.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.