Understanding the Recent Decline in Alphabet's Stock Value

Recent Decline of Alphabet Stock

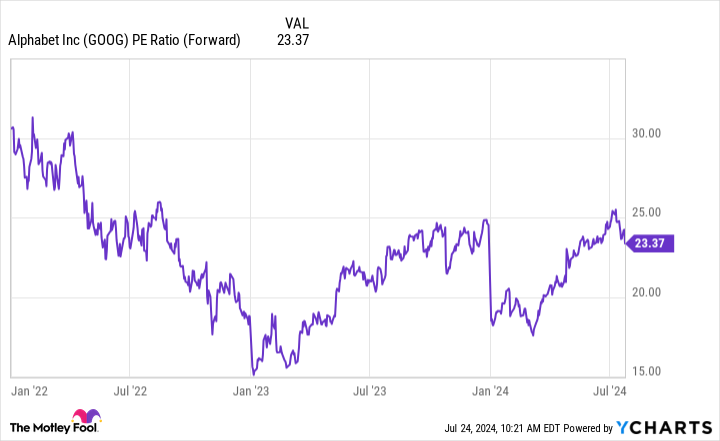

Alphabet stock is experiencing a notable decline today, despite its impressive Q2 results. Investors are questioning the reasons behind this downturn, given the positive earnings.

Factors Contributing to the Stock Drop

- Market Reactions: The stock market is notoriously unpredictable, and sometimes strong earnings don’t translate to positive stock performance.

- Investor Sentiment: Investor outlook can shift quickly, and today seems to reflect a more cautious attitude toward Alphabet.

Is This a Buying Opportunity?

With the recent *decline*, potential buyers may see this as an opportunity to invest at a lower price point. However, it’s important to consider broader market trends and the potential risks involved.

Conclusion

In conclusion, while Alphabet reported strong quarterly earnings, the current stock performance raises questions. Analyzing market trends and investor behavior will be crucial for potential investors looking for entry points.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.