Analyzing the Best Tech Stocks to Buy Amid Market Turmoil: MU, INTU, DDOG

The Tech Sector Sell-off

The tech sector experienced a chaotic sell-off on Wednesday, primarily due to uninspiring earnings reports from major players like Alphabet (GOOGL) and Tesla (TSLA). Although the results were not catastrophic, they still prompted a significant market downturn.

Reasons Behind the Market Reaction

- Overreaction: The market's response seemed more like an emotional reaction rather than a reflection of fundamental weaknesses.

- AI Market Potential: Analysts believe the AI sector may rebound despite short-term volatility.

Evaluating Top Tech Stocks

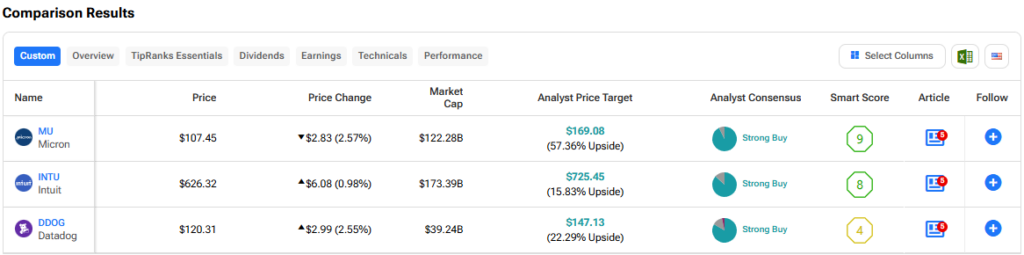

Considering the current landscape, we assess three promising tech stocks:

- Micron Technology (MU): Known for its memory and storage solutions, it shows potential for recovery.

- Intuit Inc. (INTU): A leader in financial software, it may benefit from an upturn in tech investment.

- Datadog (DDOG): Excelling in monitoring cloud applications, it remains a strong contender.

Conclusion

As the market stabilizes, investors should consider these tech stocks for potential growth opportunities. The upcoming days will be critical in determining the future performance of these companies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.