Inflation Concerns Could Impact Stock Market Performance, Warns Jason Katz

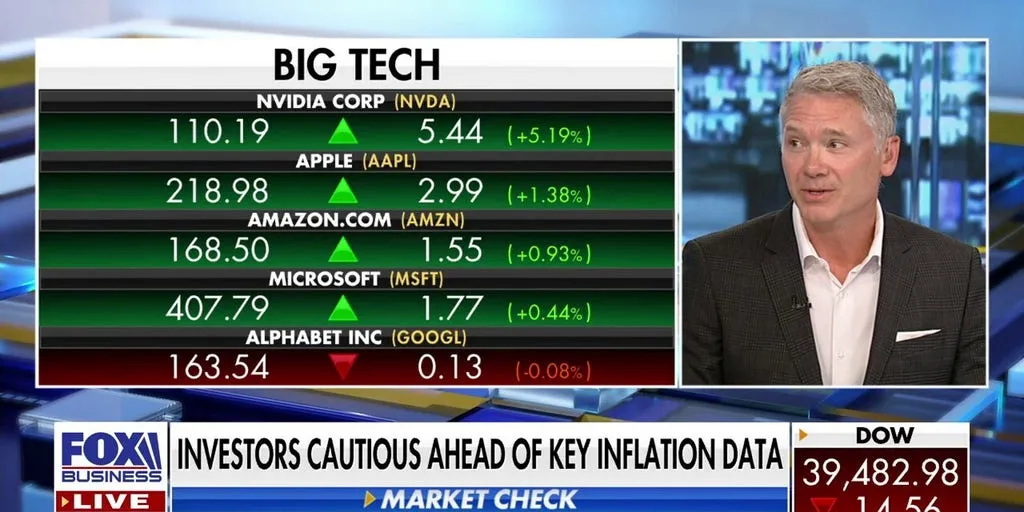

Inflation Data and its Impact on the Stock Market

According to Jason Katz, managing director and senior portfolio manager at UBS, the stock market faces potential risks if upcoming inflation data falls short of expectations. Katz emphasizes that a disappointing inflation report could lead to the market being 'walloped', highlighting the fragile nature of current market sentiment.

Interest Rate Cuts and Market Reactions

In his analysis on 'Varney & Co.', Katz elaborates on how the Federal Reserve's decisions regarding interest rates will play a crucial role this year. He anticipates a limited number of cuts, creating a delicate balancing act for investors.

- Market Vulnerability: A significant downturn is possible if inflation data disappoints.

- Fed Rate Cuts: Limited cuts are expected, impacting investment strategies.

- Investor Caution: Staying alert is essential in the current environment.

In conclusion, the upcoming inflation data holds substantial implications for the stock market. Investors must prepare for the volatility that could arise from shifts in inflation expectations and Federal Reserve policies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.