CBOE Volatility Index and S&P 500 Index Impact on Investment Strategy

CBOE Volatility Index and S&P 500 Index Overview

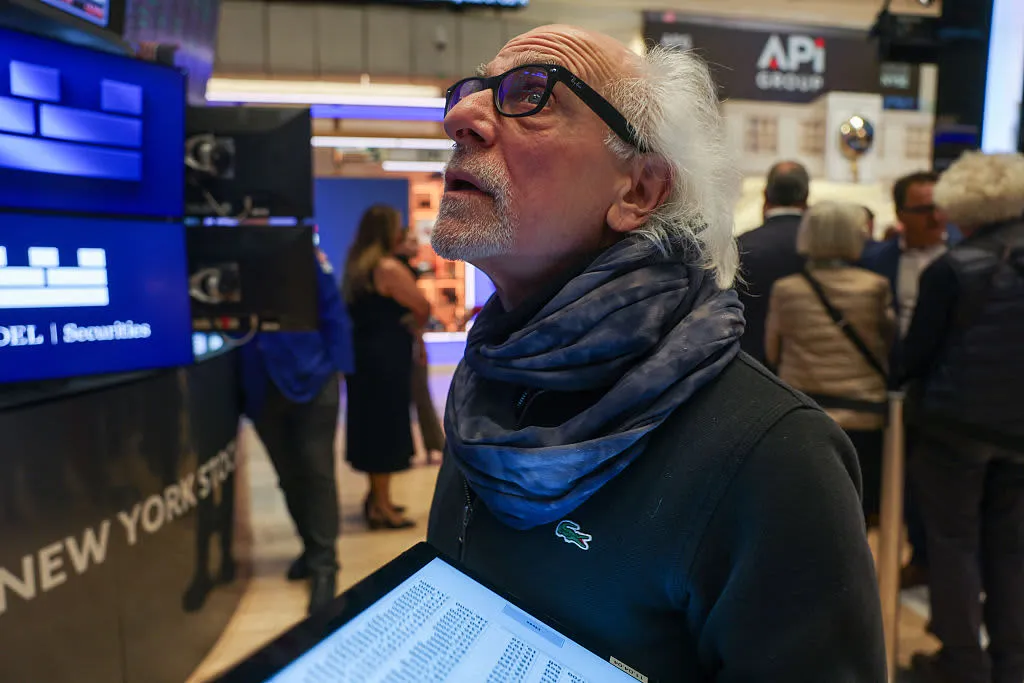

The CBOE Volatility Index (VIX) and S&P 500 Index are pivotal in assessing business news and market performance. As volatility increases, understanding these indices can shape your investment strategy.

Stock Markets Analysis

Analyzing the current state of stock markets using VIX and S&P 500 provides investors with vital insights. The VIX often exhibits an inverse relationship with market optimism.

Investment Strategy Insights

- Consider using VIX to gauge market sentiment.

- Monitor S&P 500 trends for long-term strategies.

- Balance your portfolio based on volatility metrics.

With an effective strategy, one can navigate changes in market conditions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.