401(k) Withdrawals: What You Need to Know About Early Retirement Account Access

Understanding 401(k) Withdrawals

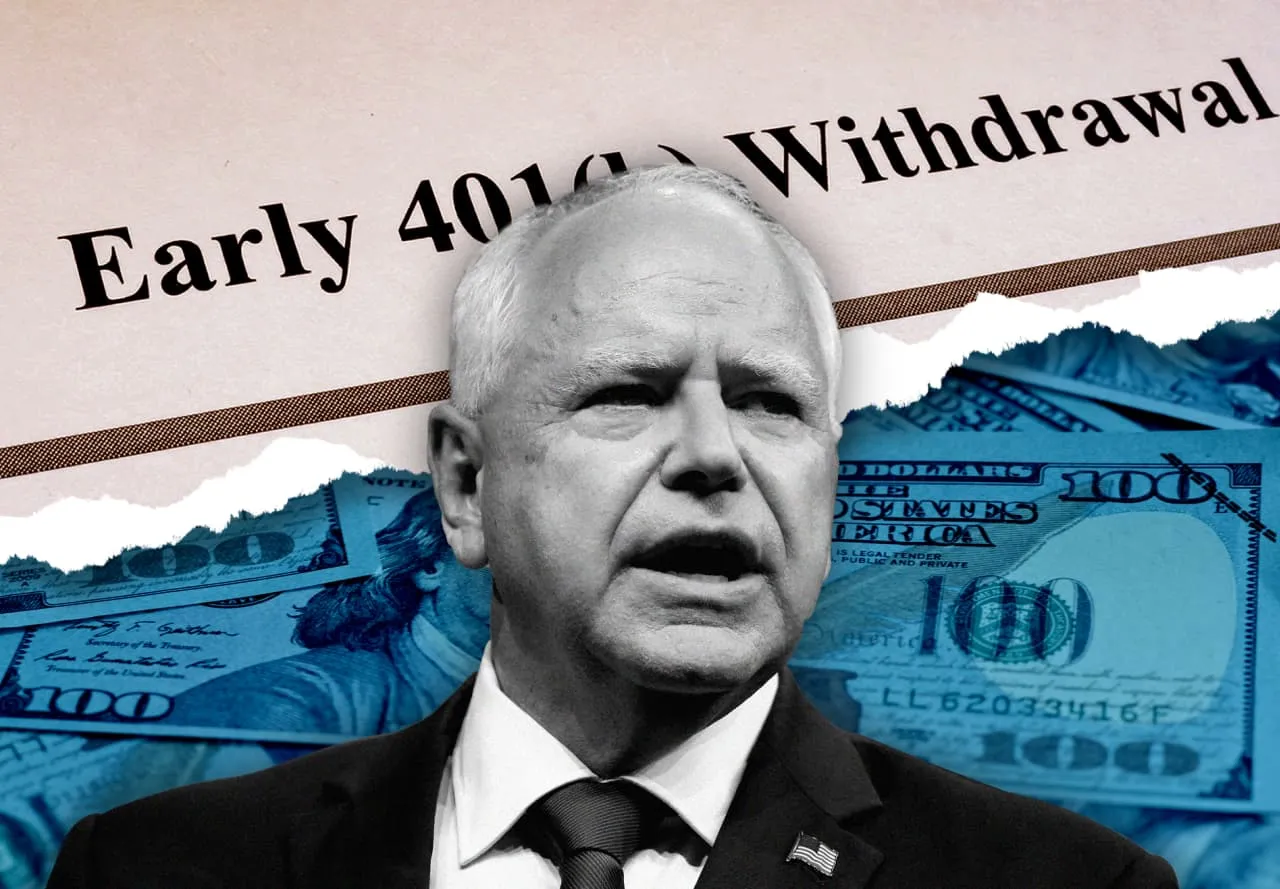

Tim Walz recently made headlines for taking early withdrawals from his 401(k), prompting discussions on retirement planning. This act raises important questions concerning the accessibility of retirement funds.

Is It Ever OK to Withdraw Early?

Withdrawing from a 401(k) before reaching retirement age can come with significant penalties and tax implications. It’s crucial to consider alternatives before making such a decision.

- Evaluate the Necessity: Assess financial needs carefully.

- Consider Other Options: Look at loans or other financial resources.

- Plan Strategically: Long-term impacts on retirement savings must be considered.

Retirement Planning Considerations

Retirement planning should account for potential financial emergencies. Understanding the rules surrounding your retirement accounts can save you from future financial woes.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.