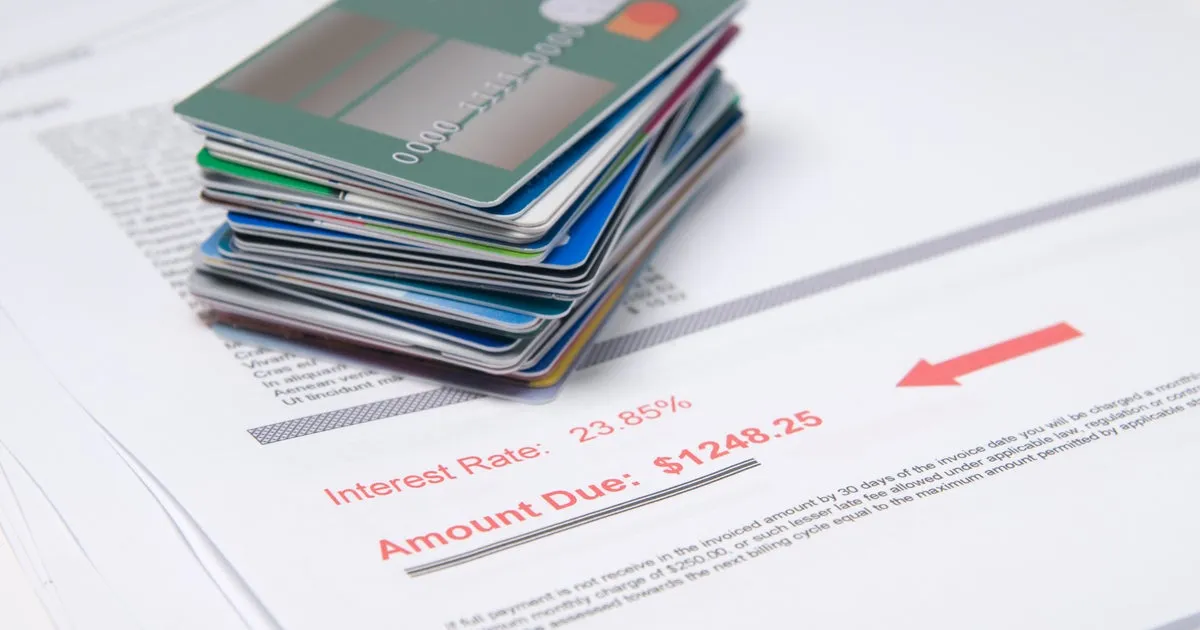

Will Credit Card Companies Comply with Trump's 10% Interest Rate Cap?

Trump's 10% Credit Card Rate Cap: A Critical Deadline

As of January 20, President Trump's mandate for credit card companies to lower interest rates to 10% remains largely unfulfilled. Most banks and issuers are pushing back against the request, citing insufficient policy details that complicate compliance.

Context Behind the Deadline

Mr. Trump announced this cap on January 9, providing a brief window of 11 days for financial institutions to adapt. Despite the urgency, many have chosen to maintain their existing rates.

The Implications of Non-Compliance

- Consumer Impact: Higher rates can lead to increased debt for consumers.

- Bank Responses: Issuers are concerned about profitability and risk management.

- Policy Challenges: Without clear guidelines, compliance remains ambiguous.

Key Takeaways

The impending deadline for credit card companies to adhere to Trump's 10% interest rate cap is approaching, but most seem unprepared to comply. The lack of clarity in the associated policy raises questions about the financial industry's ability to respond effectively.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.