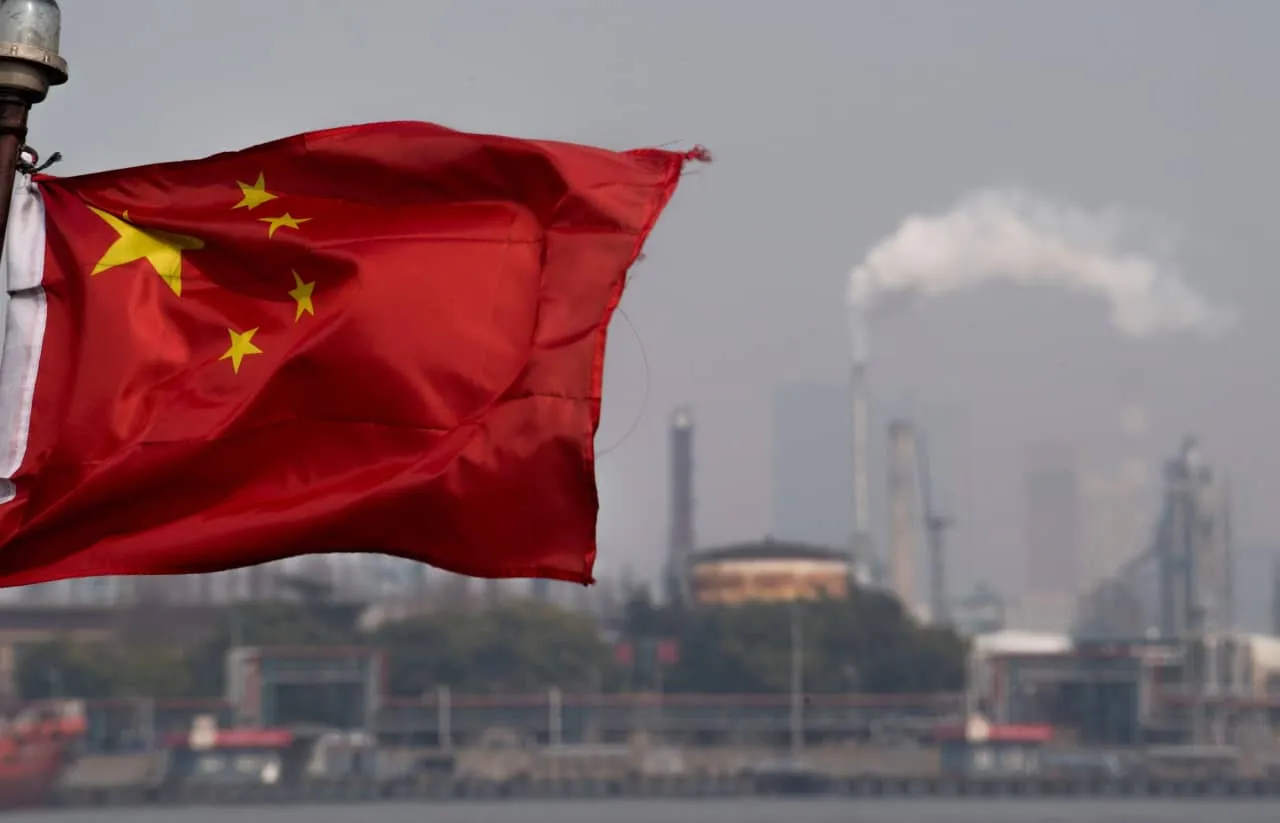

Oil Futures Hit Hard After Disappointing Figures from China

Understanding the Impact of Economic Data on Oil Futures

Oil futures experienced a downturn on Tuesday, primarily due to ongoing worries about energy demand from China following another set of disappointing economic reports. The commodity markets have shown noticeable reactions to shifts in Chinese economic indicators, signaling the intricate ties between global economics and energy markets.

Market Reactions and Future Implications

The decline in oil prices poses questions about the resilience of crude oil markets and derivatives markets. Analysts are closely observing how these economic challenges might influence demand going forward.

- Crude Oil WTI (NYM $/bbl) under pressure

- Brent Crude Oil Continuous Contract reacts to global signals

- Potential impacts on energy markets expected

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.