Crash Insights: Robert Kiyosaki Declares the Biggest Stock Market Decline Has Commenced

Understanding the Current Financial Crisis

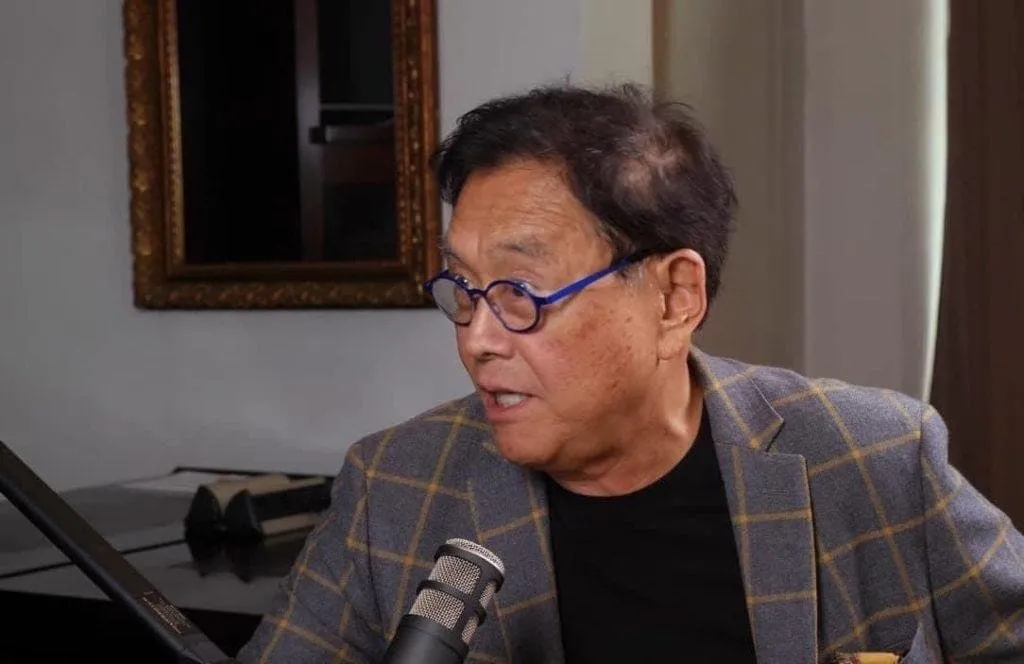

Robert Kiyosaki, a prominent investor, has issued alarming warnings about a major stock market crash that he believes has already commenced. This bold assertion was made during an interview with ITM Trading’s Daniela Cambone on September 6, where Kiyosaki highlighted the ongoing financial turmoil concerning particularly vulnerable segments like the bond markets.

Kiyosaki's Insights on Financial Corruption

According to Kiyosaki, the corruption that pervades financial systems is a key factor that renders traditionally safe investments like bonds unreliable. He pointed out that while many financial planners tout these investments as safe, the truth is the system is on the verge of collapse. Kiyosaki remains steadfast in his recommendation that investors focus on gold and silver as more stable options.

Defining the Crisis: Depression vs. Recession

In his discussion, Kiyosaki referenced economic expert James Rickards, emphasizing that the collapse of financial structures has been in motion since 2008, which he defines as a financial depression characterized by stagnant growth. The widespread belief that markets are stable masks the underlying issues that are emerging.

Identifying Hidden Dangers in Banking

Under Kiyosaki's analysis, the so-called safest bank in the world, Credit Suisse, is struggling financially but remains unseen by the average investor. This highlights Kiyosaki's view that numerous precarious situations are lurking beneath the surface.

The Five Gs for Survival

- Gold - A reliable asset to weather financial storms.

- Grub - Essential food supplies; “the Fed cannot print cattle.”

- Ground - Real estate investments for stability.

- Gasoline - Vital for energy security during turbulent times.

- Guns - Kiyosaki suggests preparedness for societal unrest.

Kiyosaki's urgent message encapsulates the need for individuals to rethink their approach to investments and assets as society braces for significant economic challenges.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.