Yield Curve Adjustments: Understanding the 'Un-'Inversion Phenomenon

Yield Curve Dynamics

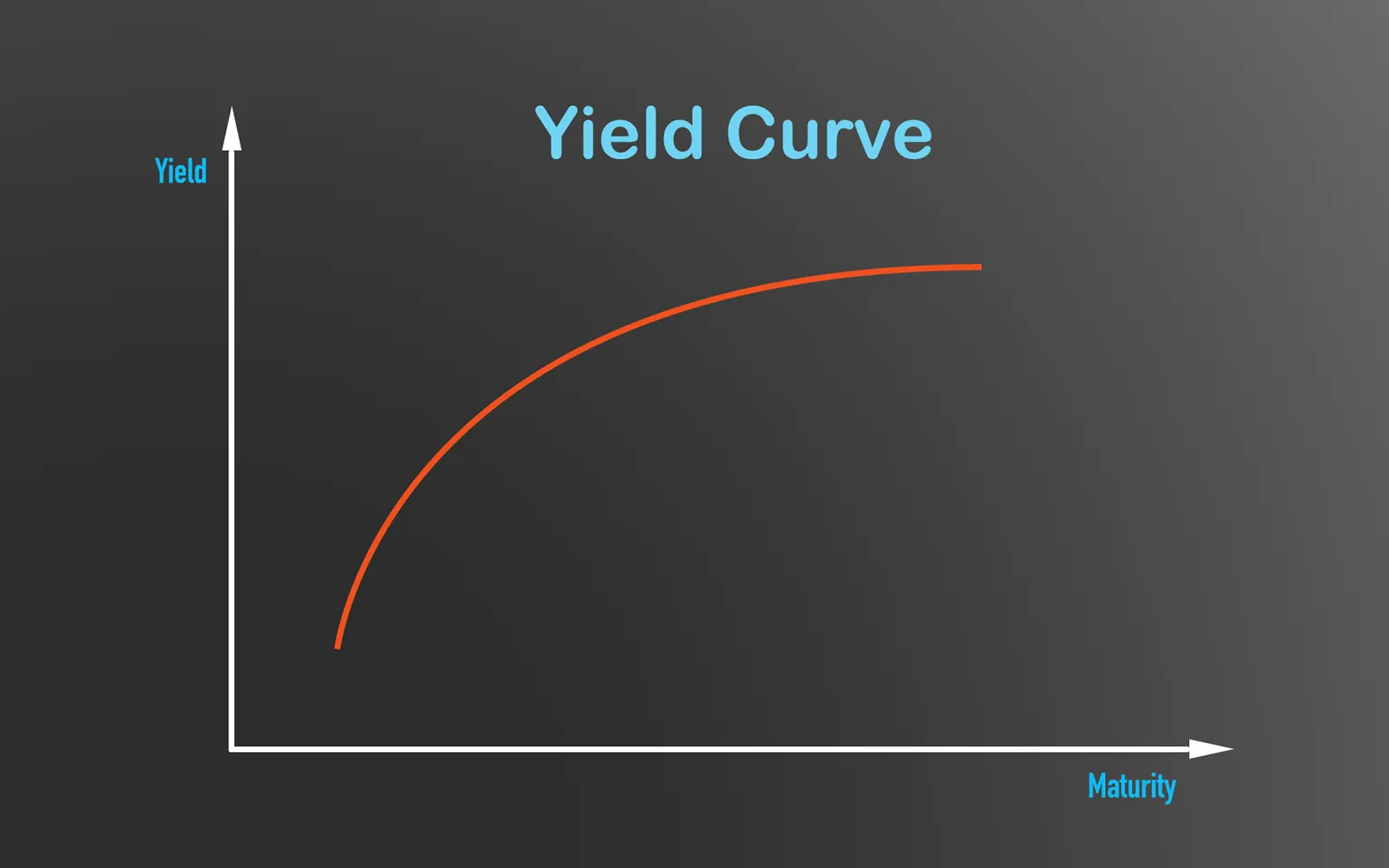

The UST 2-Year/10-Year yield curve has recently made headlines as it transitions into positive territory, signaling potential economic shifts. The motivation behind this adjustment is rooted in increasing expectations for aggressive rate cuts, a reaction to the latest labor market data, which shows signs of cooling.

Market Reactions and Expectations

- The yield curve serves as a vital economic indicator.

- Investors are adjusting their positions based on these new forecasts.

- Analysis suggests that this may impact inflation expectations.

Potential Implications

With the yield curve revealing shifts, the market watches closely. As expectations for interest rate adjustments evolve, the financial landscape could experience notable changes. Understanding these trends is crucial for strategizing portfolio allocations.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.