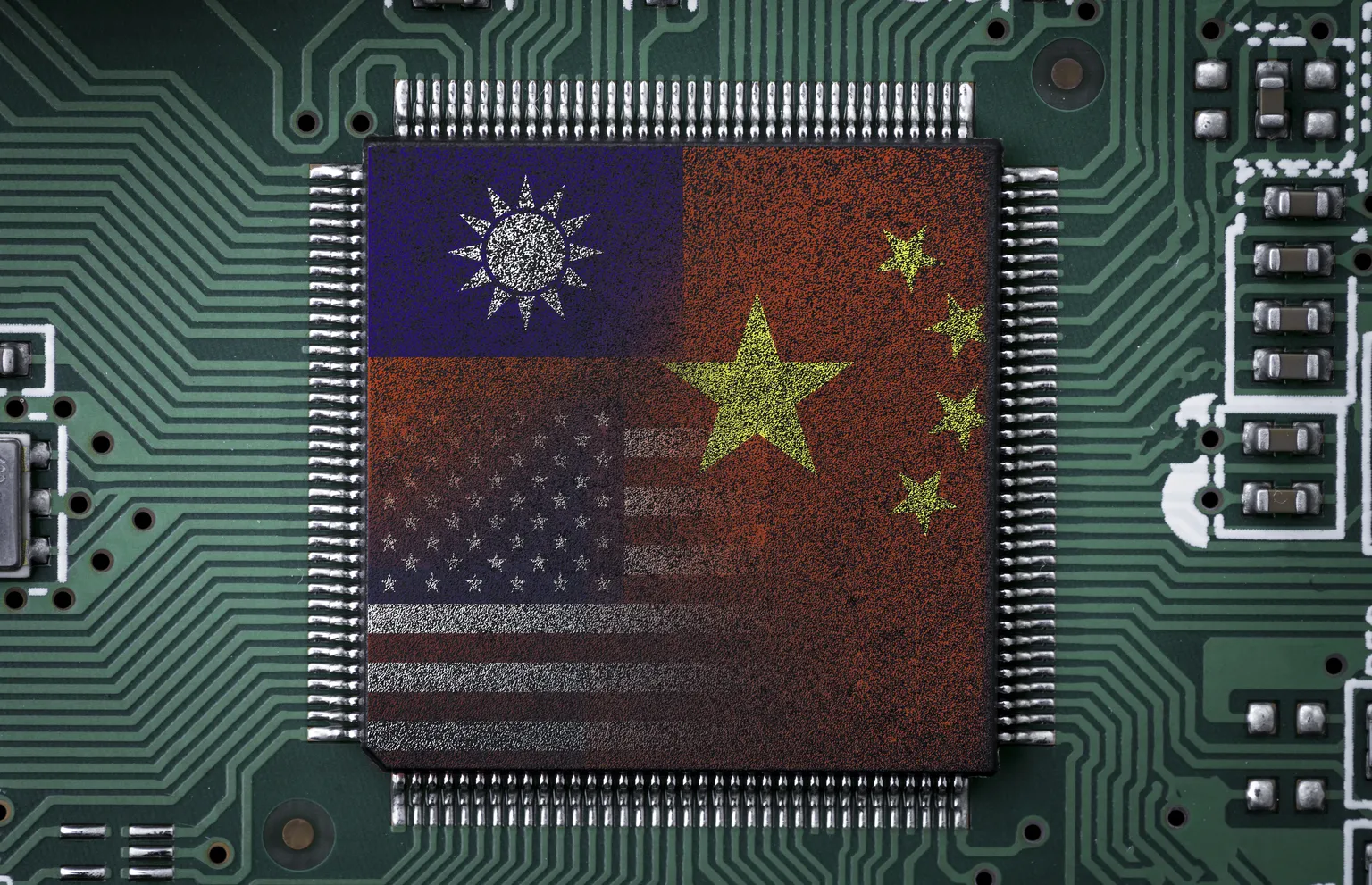

GlobalFoundries’ Compounding Mistake Against Taiwan Semi: A Haunting Outlook

Market Outlook Based on GlobalFoundries’ Performance

GlobalFoundries’ approach towards Taiwan Semi has resulted in a haunting outlook for the company. With analysts projecting a 12-14% decrease in stock value, it raises questions about future performance. The comparison with other players in the market highlights the costly mistake made by GlobalFoundries. This strategic error could have lasting implications for investor sentiment.

An Expensive Valuation

Currently, GlobalFoundries' valuation appears expensive when juxtaposed with its peers, drawing critical scrutiny from analysts:

- Projected downside of 12-14%

- Comparative analysis raising red flags

- Potential for diminished investor trust

Next Steps for Investors

In light of the outlook, I issue a Hold rating on GFS stock. Caution is advised as market dynamics shift rapidly. Keeping a close watch on industry trends will be essential.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.