Intel's Value Proposition: Analyzing 'Cheap' Stocks in Tech

Intel's Current Market Position

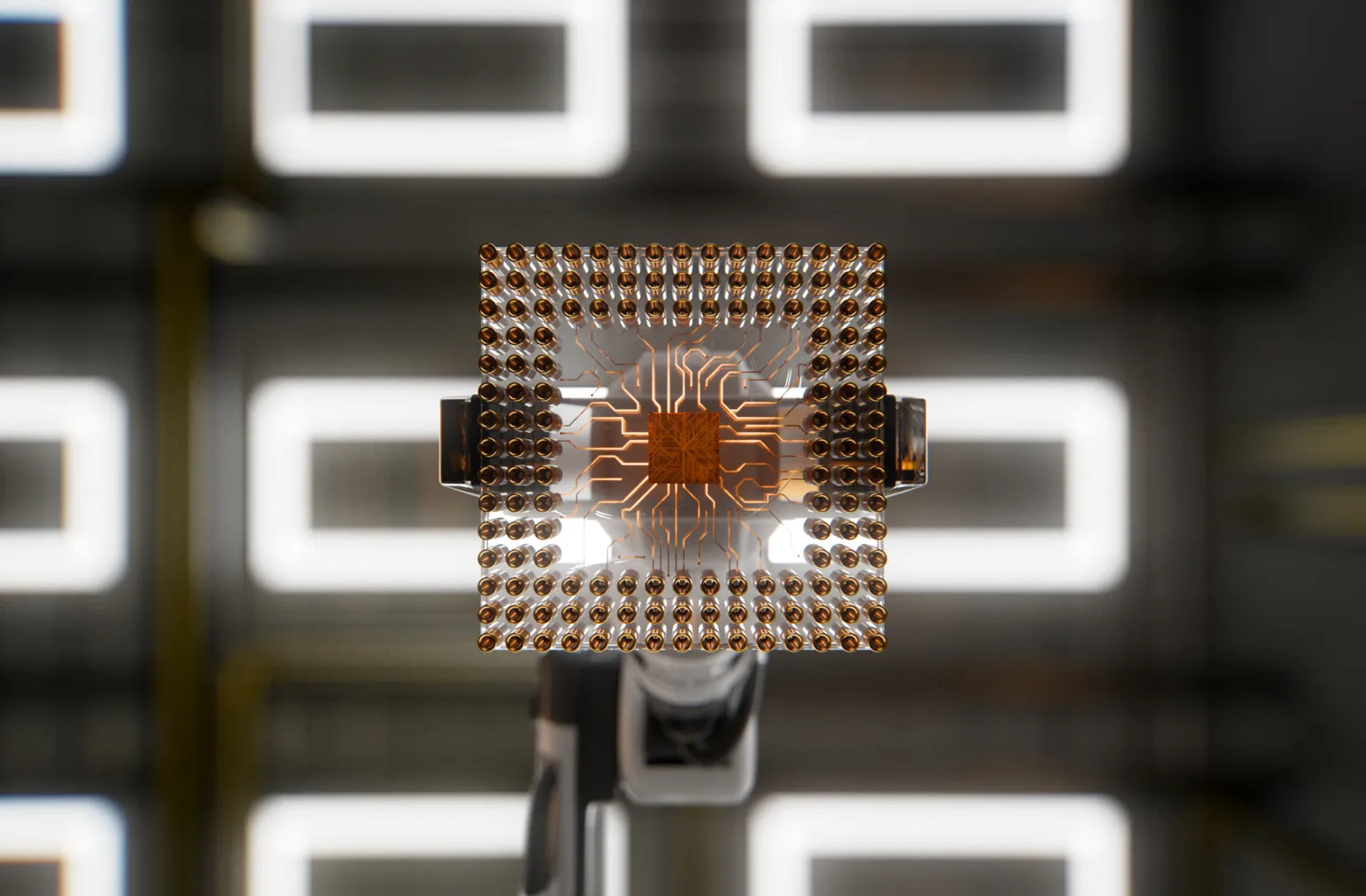

Intel has recently garnered attention for its low-priced stock trading below book value. Investors might find this attractive; however, a deeper analysis reveals that the company struggles with key innovations and market competition.

Why 'Cheap' Isn't Always Attractive

- Missing Growth Catalysts: Without new products or technology breakthroughs, Intel may remain stagnant.

- Market Competition: High competition from other chipmakers raises doubts about Intel’s ability to rebound.

Evaluating INTC Stock

Given these factors, holding INTC stock might be a prudent decision. The investment lacks enough stimuli to promote substantial growth in the near term.

Understanding Investment Strategies in Tech

Investors must consider both current value and future potential when assessing tech stocks. Intel serves as a vital reminder: a low price does not equate to a sound investment.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.