Taiwan Semiconductor: Analyzing the Unique Arbitrage Opportunity in Semi Manufacturing

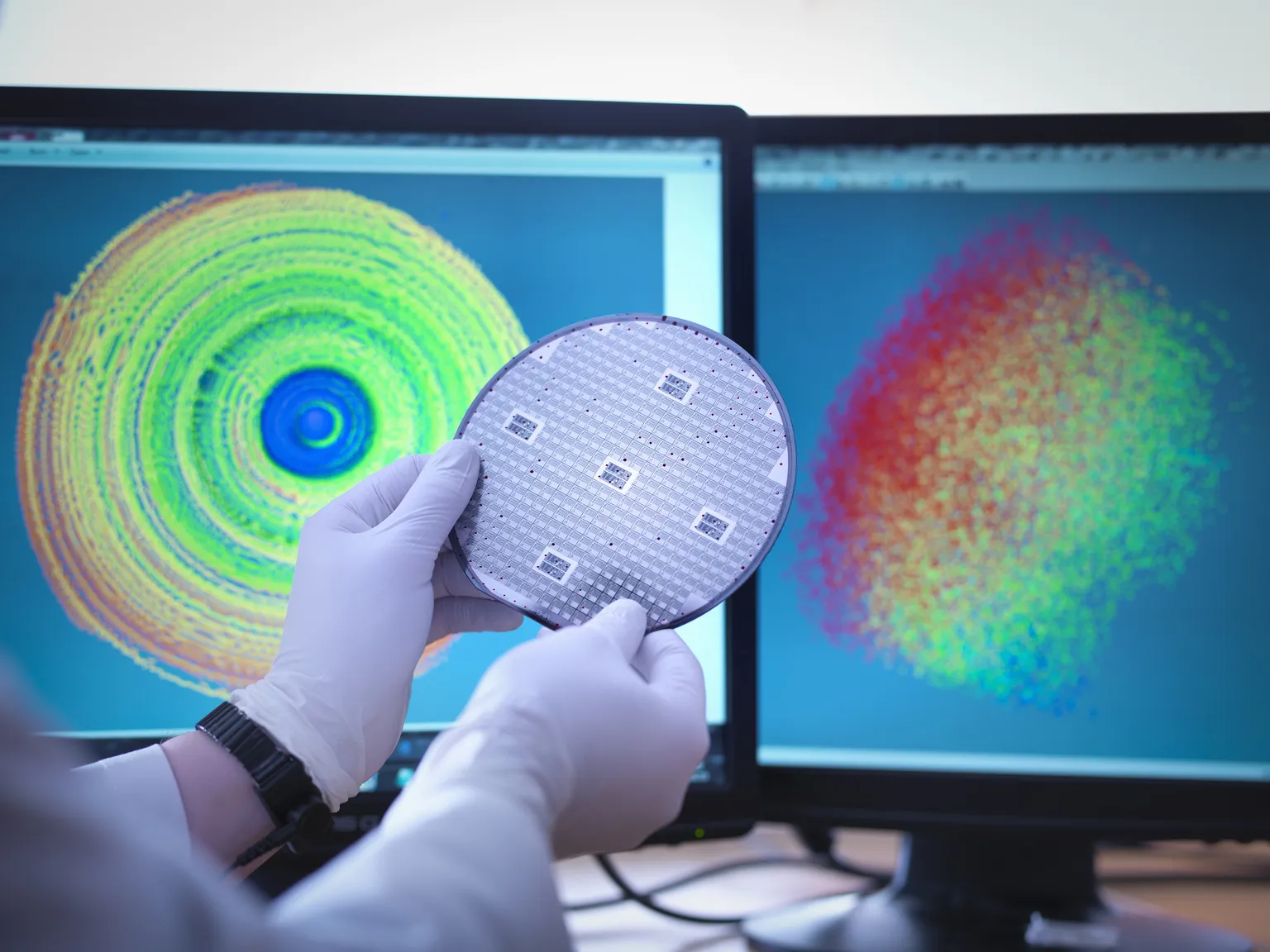

Taiwan Semiconductor's Strategic Position

Taiwan Semiconductor (NYSE:TSM) is increasingly poised to leverage new government subsidies aimed at fostering local semiconductor manufacturing. This shift presents a unique arbitrage opportunity for investors looking to capitalize on the evolving industry dynamics.

Government Incentives and Localized Production

Recent moves by governments worldwide to promote local semiconductor production are reshaping the market. TSM is well-positioned to benefit from these incentives significantly, enhancing its competitive edge.

Potential Challenges Ahead

Nevertheless, the path is not devoid of challenges. With emerging competitors and geopolitical factors influencing the semiconductor space, TSM must navigate these turbulent waters effectively.

- Rising competition from peers

- Regulatory hurdles

- Market demand fluctuations

Conclusion: A Buy Recommendation

Given the alignment of TSM's strategic advantages with governmental policies and the projected growth in semiconductor demand, I rate TSM stock a Buy. Investors should closely monitor this opportunity as the industry landscape evolves.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.