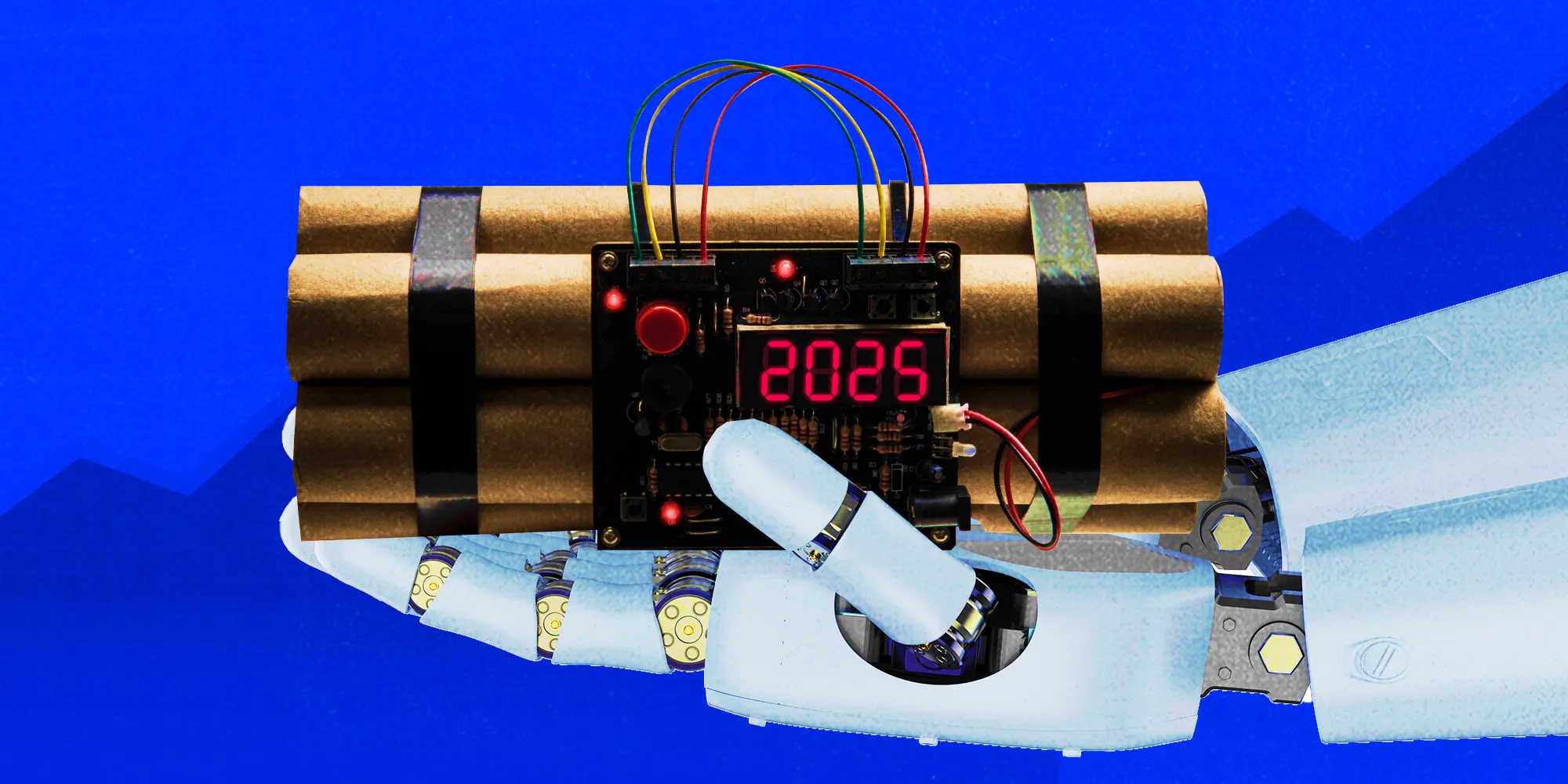

Understanding the Accounting Risks in AI Investments by 2025

Sunday, 11 August 2024, 05:16

Introduction

With the rapid growth of AI technology, investors are keenly observing the market for potential gains. However, a hidden risk could emerge due to a specific accounting method.

The Accounting Method Explained

- This method enables firms to spread the cost of new technology over several years.

- While this can be beneficial for cash flow, it may lead to future problems for companies investing heavily in AI.

Potential Implications for AI Firms

- Finance Discrepancies: Companies may face challenges in accurately reporting finances.

- Stock Market Impact: These discrepancies could negatively affect stock performance.

Conclusion

Investors should remain vigilant about how these accounting practices may influence the performance of AI stocks in the coming years, especially for those companies leading the AI chip market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.